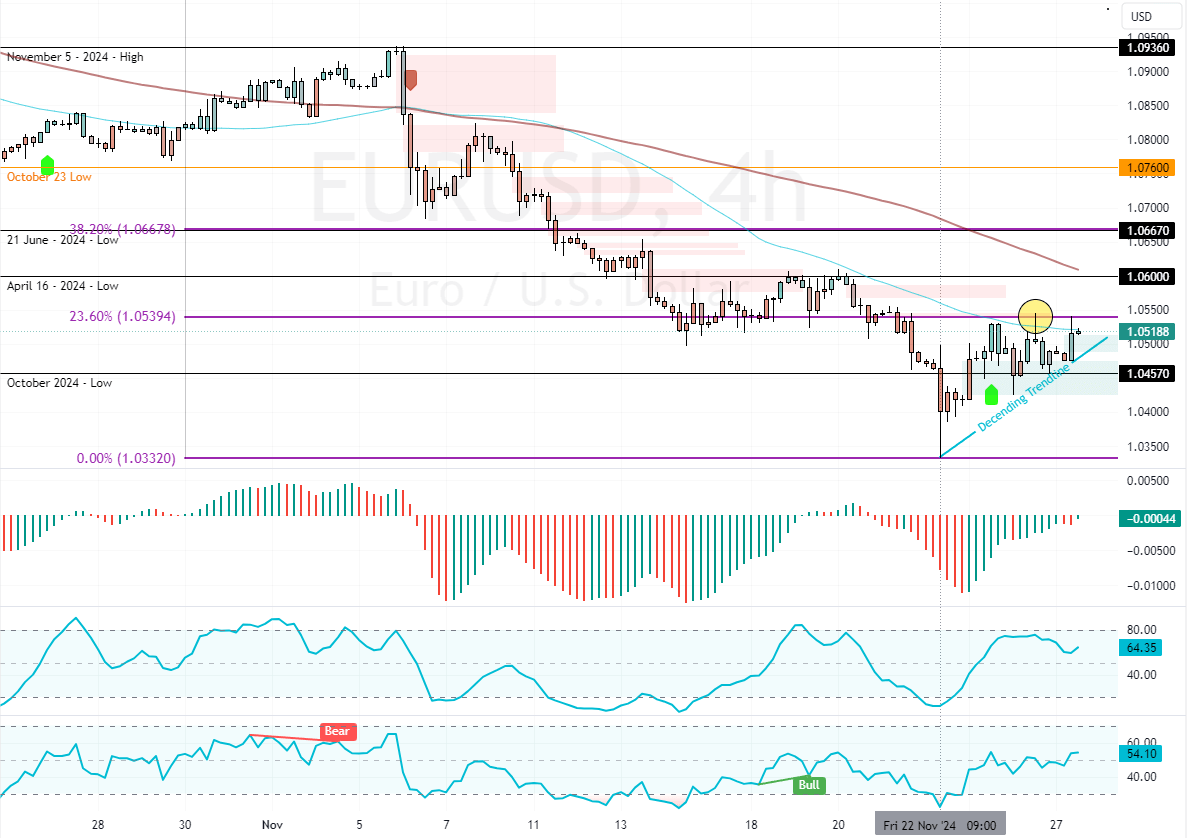

FxNews—As expected, the EUR/USD pair began a consolidation phase from $1.033 because the RSI 14 and Stochastic were signaling oversold then. As of this writing, the currency pair tests the 23.6% Fibonacci retracement level at approximately $1.05.

EUR/USD May Test Upper Resistance Soon

Please note that the primary trend is bearish because the prices are below the 100-period simple moving average.

However, the Awesome Oscillator and RSI 14 are rising, meaning the bull market is strengthening. Therefore, EUR/USD can potentially test the upper resistance levels.

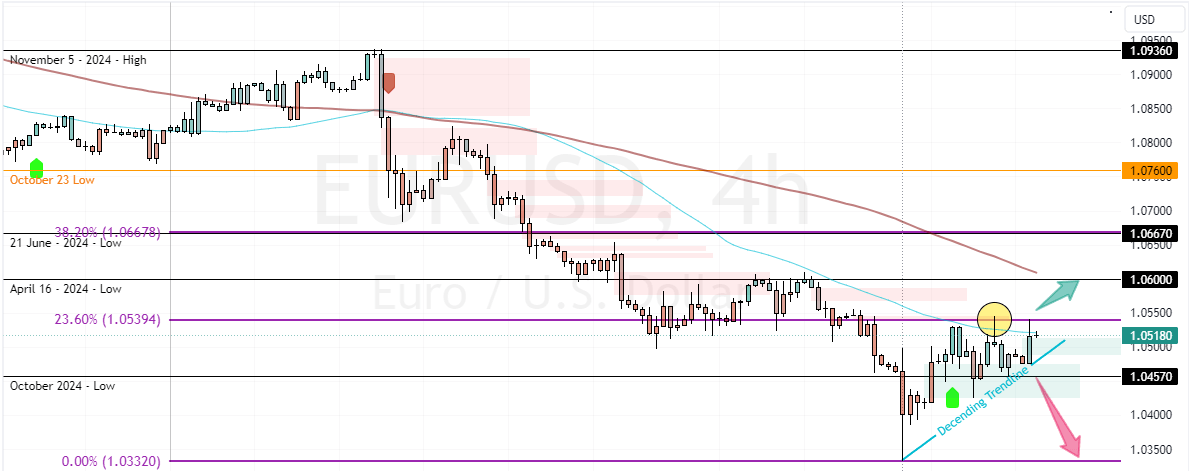

EURUSD Nears Prime Levels for Bearish Entries

The immediate bullish barrier is $1.053, backed by the 50-period SMA and the 23.6% Fibonacci resistance level. Meanwhile, the young ascending trendline supports the immediate support at $1.045.

From a technical perspective, the downtrend will likely resume if bears push EUR/USD below $1.045. In this scenario, the market will likely aim toward the November low at $1.033.

Bullish Scenario

On the other hand, the current uptick in momentum could extend if bulls pull EUR/USD prices above the immediate resistance. If this scenario unfolds, the next bullish target could be testing the 1.06 resistance, backed by the 100-period simple moving average.