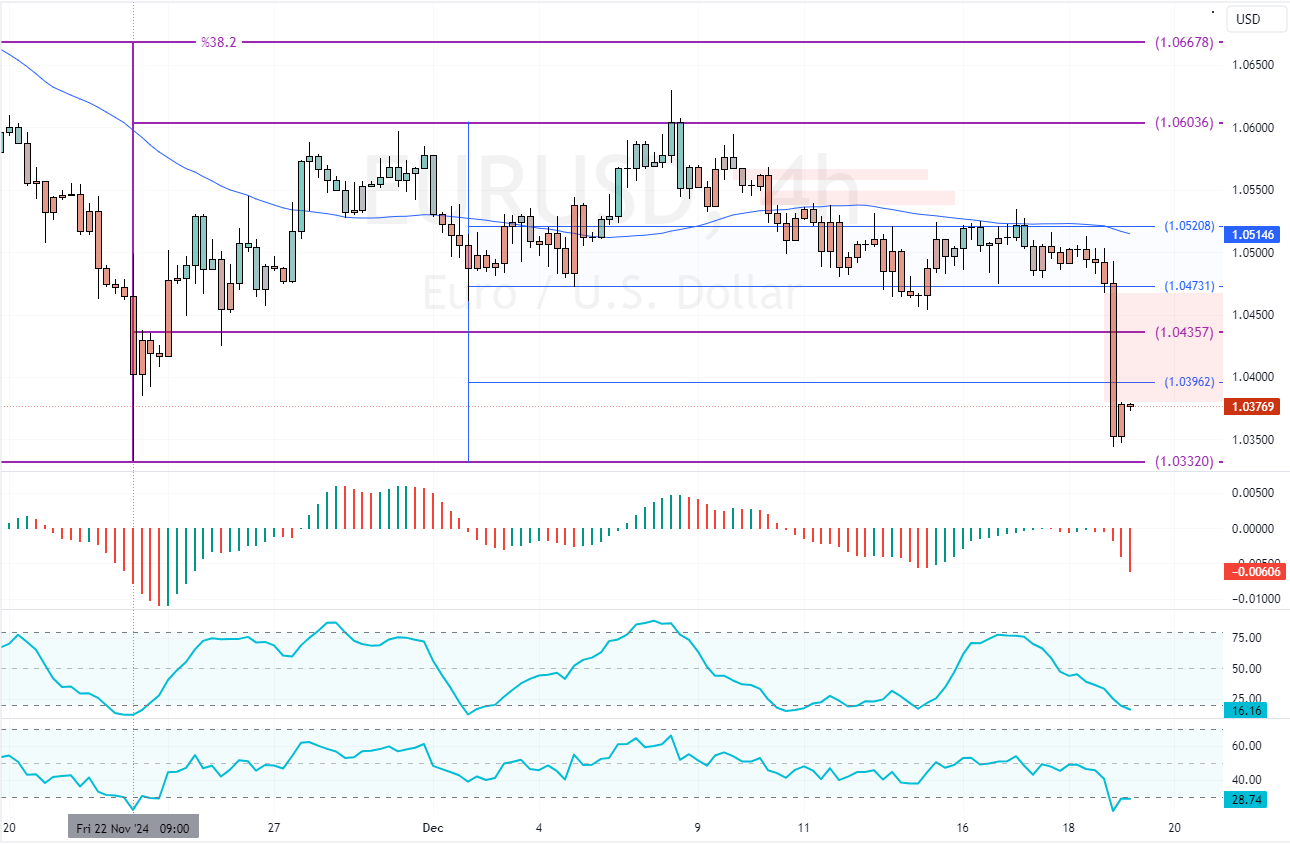

EURUSD dipped to a November low at $1.0332, testing this mark as support. Momentum indicators hint at an oversold market, which could cause prices to consolidate before the downtrend resumes.

EURUSD Technical Analysis – 19-December-2024

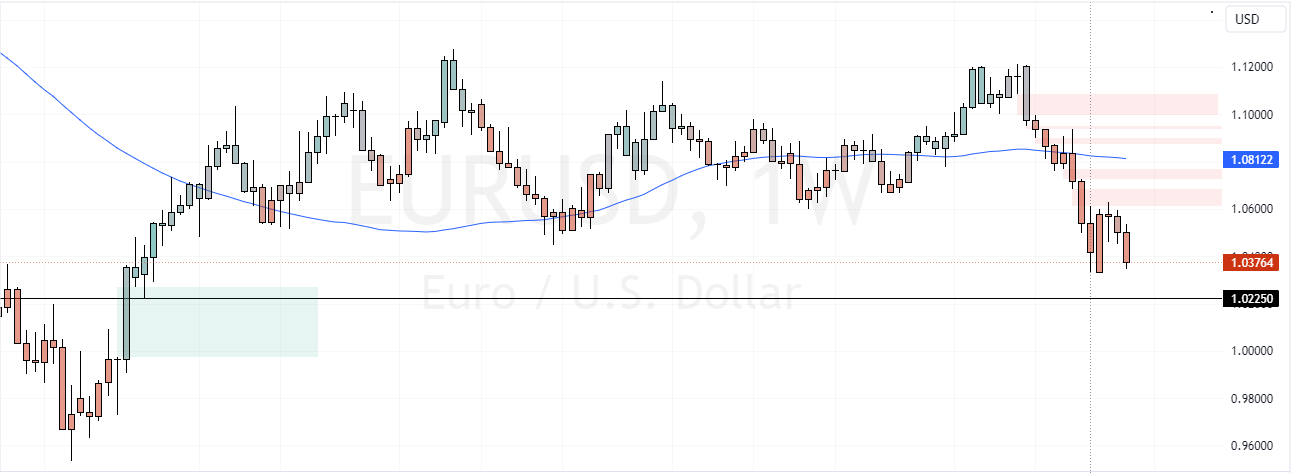

The European currency (euro) trades in a robust bear market at approximately 1.037 against the Greenback. Yesterday, the downtrend was triggered again after the pair broke the $1.043 support.

At the time of this writing, the Stochastic and RSI 14 indicators show values of 16 and 28, respectively, suggesting that the American dollar is overpriced in the short term. This analysis helps explain why the downtrend has stabilized near the key support level of $1.0332.

Therefore, the market expects a new consolidation phase toward upper resistance levels before the downtrend resumes.

Potential EURUSD Gains Above 1.039

Immediate resistance is $1.039, backed by the bearish fair value gap. A new consolidation could emerge if EUR/USD prices flip above this level ($1.039). In this scenario, the euro will likely erase more of its recent losses by aiming toward $1.0435 resistance.

- Also read: GBPJPY Faces Dip Risking The 194.5 Support.

Traders and investors should monitor 1.0396 and 1.0435 key resistance levels for bearish signals, such as candlestick patterns, to plan their strategies for joining the bear market.