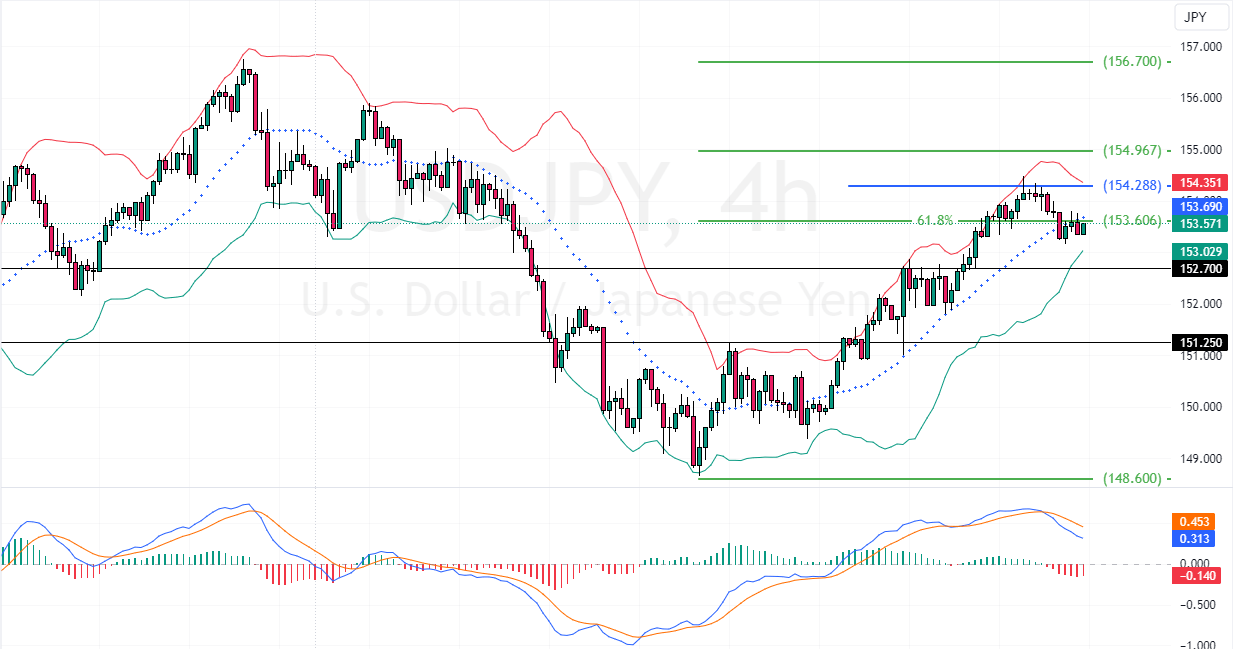

The value of the USD/JPY currency pair dropped slightly to 153.0, giving back 0.03% of its earlier gains. This happened as market participants prepared for an update from the US Federal Reserve.

It’s widely anticipated that the Fed will lower interest rates by a quarter of a percent today. However, due to ongoing high inflation, the Fed is also expected to suggest that it will make fewer rate cuts next year.

Bank of Japan May Delay Rate Hikes

Meanwhile, in Japan, there is increasing belief that the Bank of Japan might postpone raising interest rates. This comes after indications that the Bank sees no significant downside to delaying further monetary tightening.

Japanese officials seem cautious, wanting to review more economic data to confirm the country’s financial health before making further policy adjustments.

- Next good read: AUDUSD Hits Yearly Low Ahead of Fed Rate Decision

Additionally, Japan’s exports rose to the highest level in three months in November, while imports fell short.