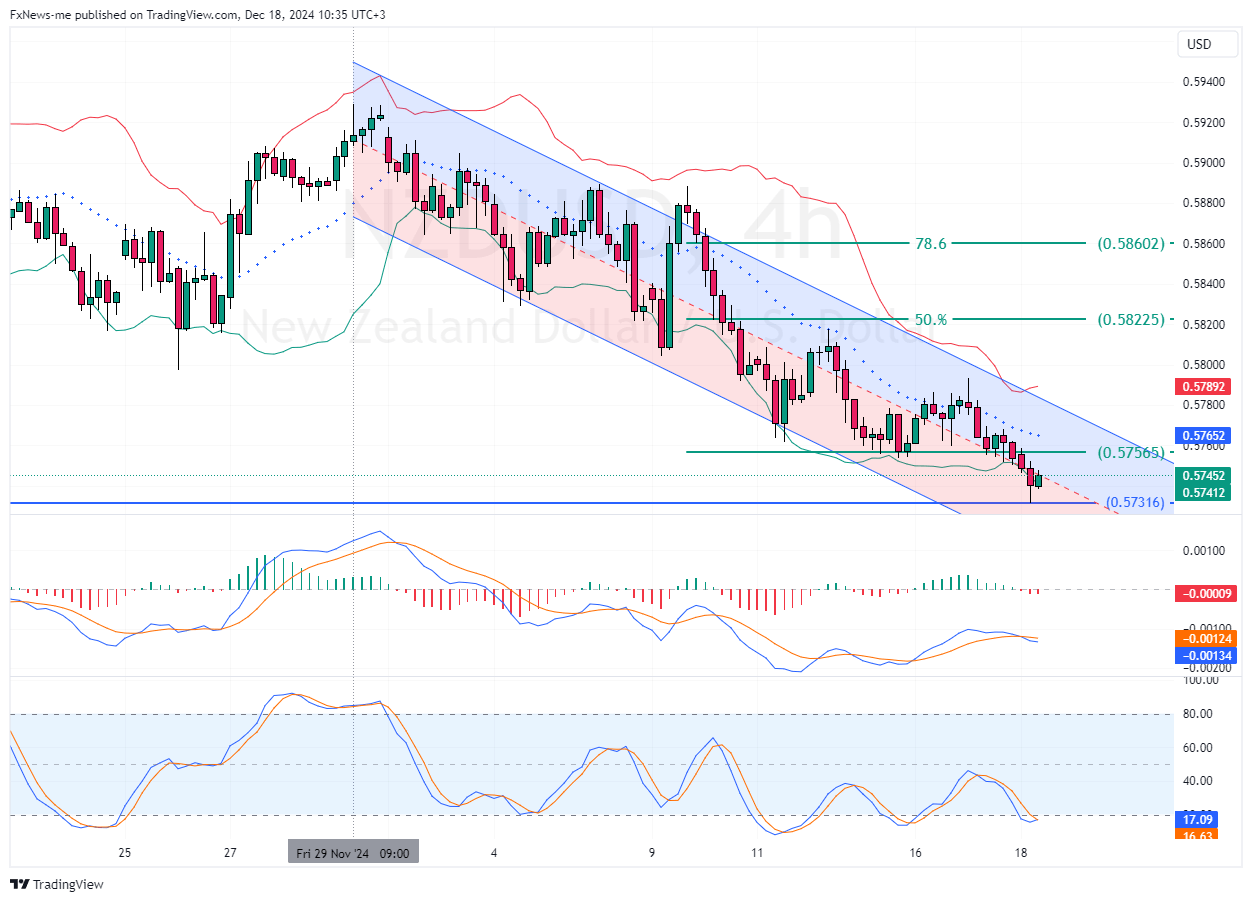

On Wednesday, the NZD/USD currency pair resumed its bearish trajectory and fell to approximately $0.573, its lowest point over two years. The market caution persisted regarding the upcoming decision on interest rates by the US Federal Reserve.

China’s Economy Affects NZ Dollar and Rate Plans

Although a decrease in New Zealand’s interest rate is expected, there’s growing concern about how quickly rates might be reduced next year. Furthermore, recent weak economic indicators from China have caused additional anxiety, impacting the New Zealand dollar negatively because New Zealand counts on China as a major buyer of its exports.

Domestically, all eyes are on the upcoming report on New Zealand’s economic performance in the third quarter, which is expected to reveal a further economic downturn.

- Also read: GBPUSD Rises on Strong UK Wage Data.

Westpac Reveals Q4 Rise in Consumer Confidence

On a positive note, a recent Westpac survey indicated a rise in consumer confidence in the fourth quarter to 97.5, up from 90.8 in the previous quarter. This marks the highest level of optimism in three years, though it is still below the average historical levels.