An Introduction to the World of Forex Trading

Forex trading, or foreign exchange trading, is a global marketplace where individuals, businesses, and financial institutions buy and sell currencies. The primary objective of this activity is to profit from fluctuations in the value of one currency against another.

This market operates 24 hours a day, five days a week, making it accessible to anyone worldwide with an internet connection. This guide will provide you with a comprehensive understanding of the basics of Forex trading.

Decoding the Concept of Forex Trading

Forex trading is essentially about exchanging one currency for another. It’s a process that involves predicting whether the value of one currency will rise or fall compared to another. For instance, if you expect the US dollar to strengthen against the euro, you could sell the EUR/USD currency pair. If your prediction comes true and the dollar strengthens, you could sell the pair for a profit.

Let’s consider an example. Suppose you buy 1,000 euros at an exchange rate of 1.10 USD/EUR. This means you spend 1,100 dollars. After some time, if the exchange rate changes to 1.15 EUR/USD and you decide to sell your euros, you would receive 1,150 dollars, making a profit of 50 dollars.

The Role of Currency Pairs in Forex Trading

In Forex trading, currencies are always traded in pairs. The first currency in the pair is known as the ‘base’ currency, while the second is referred to as the ‘quote’ or ‘counter’ currency.

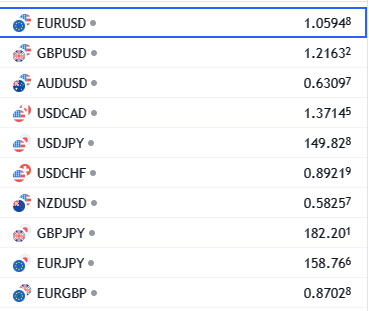

The most frequently traded pairs are referred to as majors. These include EUR/USD (Euro/US Dollar), USD/JPY (US Dollar/Japanese Yen), GBP/USD (British Pound/US Dollar), and USD/CHF (US Dollar/Swiss Franc).

For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency. If EUR/USD trades at 1.20, 1 euro equals 1.20 US dollars.

Market Analysis: A Key Aspect of Forex Trading

Conducting market analysis is crucial to succeeding in Forex trading. There are two main types of market analysis: fundamental and technical.

Fundamental analysis involves evaluating a country’s economic indicators and performance to predict future movements in its currency value. For example, if a country’s GDP growth rate is high, its currency might strengthen.

On the other hand, technical analysis involves studying price charts to identify patterns and trends that can help predict future price movements. For instance, if a price chart shows a consistent upward trend over time, it might indicate that the currency’s value will continue to rise.

Market Basket Analysis in Forex Trading

In Forex trading, Market Basket Analysis is applied in a unique strategy known as Forex Basket Trading. This strategy involves trading multiple currency pairs simultaneously, which could be either correlated or uncorrelated.

Let’s consider an example. Suppose you’re trading two currency pairs: EUR/USD and GBP/USD. If the USD strengthens, both EUR/USD and GBP/USD will likely fall. You could profit from both trades if you sold these pairs (meaning you’re betting on them to lose).

Forex Basket Trading offers several benefits. First, it provides diversification. By trading multiple currency pairs simultaneously, you spread your risk across several trades instead of just one. Second, Forex Basket Trading can create more profit opportunities. You can take advantage of different market trends by trading multiple currency pairs simultaneously.

For instance, if the USD is strengthening and the JPY is weakening, you could profit from selling EUR/USD (betting on it to fall) and buying USD/JPY (betting on it to rise).

Risk Management: A Crucial Element in Forex Trading

Forex trading can be risky due to the volatile nature of currency markets. Therefore, effective risk management strategies are essential.

These strategies can involve setting stop-loss orders and automatically closing out your position if losses reach a certain level. For example, if you buy a currency pair at 1.20 and place a stop-loss order at 1.15, your position will automatically be closed if the price falls to or below 1.15.

Another critical aspect of risk management is using leverage wisely. Leverage allows you to control a large amount of money with a small deposit but can also amplify potential losses if not used responsibly. For example, if you have $1000 in your account and use leverage of 10:1, you can control $10,000 worth of currency. However, while this can increase potential profits, it also increases potential losses.

Forex Risk/Reward Ratio

Understanding the concept of the risk/reward ratio is crucial. This ratio is a measure that traders use to compare the expected returns of an investment to the amount of risk undertaken to capture these returns. The risk/reward ratio quantifies how much money you’re willing to risk making a sure profit.

For instance, a risk/reward ratio of 1:3 means that you expect to make three dollars in profit for every dollar you risk.

This ratio is critical in Forex trading because it can help traders manage their risks effectively and increase their chances of long-term profitability. A good rule of thumb is to aim for a risk/reward ratio of at least 1:2 or higher. This means you desire to make two dollars or more in profit for every dollar you risk.

However, it’s important to note that the ideal risk/reward ratio can vary depending on your trading style and risk tolerance. Some traders might be comfortable with a higher level of risk and opt for a higher reward ratio, while others might prefer to take on less risk.

Forex Risk/Reward Calculations

In Forex trading, a Risk Reward Calculator is a handy tool that helps traders determine the potential profit they could make on a trade compared to the risk involved. It’s like a scale that enables you to weigh the potential gains against the possible losses.

Here’s how it works. Let’s say you’re planning a trade and set your stop loss 30 pips away from your entry point. This is the risk you’re willing to take. Now, you also put your take profit 90 pips away from the entry point. This is your potential reward.

To calculate the risk-reward ratio, you divide the risk (in this case, 30 pips) by the reward (90 pips). So, your risk-reward ratio would be 30/90 = 1:3. For every pip (or point) of risk, you expect to earn three times that in profit.

This tool is essential because it helps traders make more informed trade decisions. It allows them to determine whether a trade is worth taking based on the potential earnings versus the potential losses.

How much money is needed to trade Forex?

The capital you need to kick off Forex trading can differ significantly, influenced by factors such as your trading approach, risk appetite, and the broker you select. Here are some crucial aspects to ponder:

1. Account Size: There isn’t a set minimum amount necessary to begin Forex trading. Numerous brokers provide accounts with minimal deposits, typically from $100 to $200. For instance, a broker like XYZ offers a minimum deposit of just $100. Nonetheless, it’s vital to comprehend that trading with a minuscule account might restrict your capacity to manage risk effectively and endure temporary losses.

2. Risk Tolerance: Your risk tolerance is a vital determinant in deciding how much you ought to invest. It’s generally suggested not to risk over 2-3% of your trading capital on a single trade. If you possess a $2,000 account, you should attempt no more than $40 to $60 per trade. The more capital you have, the easier it becomes to manage risk effectively.

3. Trading Strategy: The kind of trading strategy you intend to employ also impacts how much money you require. For instance, if you’re a day trader aiming to execute small, frequent trades, you might need more capital to meet margin requirements and mitigate the effect of transaction costs. Swing or long-term traders may necessitate less capital per trade.

4. Leverage: Forex brokers frequently offer leverage, enabling you to control a more prominent position size with a comparatively small capital. While leverage can magnify profits, it also escalates the risk of significant losses. The utilization of leverage should be undertaken with caution, and it’s recommended to commence with low leverage or even trade without it when you’re new to Forex.

5. Transaction Costs: Consider transaction costs, including spreads (the disparity between the bid and ask price) and, occasionally, commissions. These costs can influence your profitability, particularly if you have a small account.

6. Education and Practice: Before making real money, educate yourself about Forex trading and practicing a demo account. ImperativeThis enables you to hone your skills and test your strategies without financial risk.

7. Risk Management: Effective risk management is crucial. Utilize stop-loss orders to limit potential losses and establish a clear risk management plan.

It’s crucial to emphasize that Forex trading involves a degree of risk, and losing the capital you invest is feasible. Hence, never invest money that you cannot afford to lose. Starting with a smaller account and gradually augmenting it as you acquire experience and confidence is a reasonable approach. Also, consider seeking advice from financial professionals or seasoned traders to assist you in developing a sound trading plan.

How old do you have to be to trade Forex?

The minimum age to start forex trading is typically 18 years old. However, you might need to be 21 years old in some places. This is because of legal rules set by authorities. It’s important to remember that you’ll need to show several types of documents, like ID and proof of address, to open a live account. Please check with your local rules or with your chosen forex broker to confirm the exact age requirement.

The Role of Brokers in Forex Trading

To trade Forex, you’ll need access to a forex trading platform, which a broker typically provides. Brokers offer various services, including access to currency pairs for trading and educational resources for traders.

For example, some brokers offer demo accounts where you can practice trading with virtual money before risking real money on trades.

Conclusion

Forex trading can be an exhilarating journey filled with ups and downs. It offers potential profits but also comes with significant risks. It requires not just knowledge and skill but also discipline and emotional control.

By understanding these basics of Forex trading and applying them in practice through careful analysis and risk management strategies, you’re taking your first step into this exciting world.

Always remember that thorough research is critical; never invest more than you can afford to lose. Here’s wishing you all the best on your trading journey!