FxNews—This is J.J. Edwards. I will help you understand leverage in trading securities such as forex, stocks, and cryptocurrencies in this article. You’ll learn how to calculate leverage and examine its pros and cons. I will also show you how to lower forex trading risks by adjusting your trade volumes wisely.

Leverage is key in forex trading. Trading with leverage is a privilege. It lets traders control bigger positions with smaller cash. But we should be careful; misusing leverage can lead to a tremendous loss. This article is about understanding how leverage works and how to mix leverage with wisdom for successful trading.

What is Leverage in Finance and Forex?

Leverage is a ratio that lets you trade more money than you have. Let’s say you have $1,000. With a 1:100 leverage, you can handle $100,000 in trades. This means that with just one dollar, you can trade for $100.

Different leverage ratios exist, including 1:50, 1:100, or even 1:1000. These ratios show how much you can control in the market with a small amount. But it’s important to know that using higher leverage affects your balance more if the market changes.

Example: Imagine you’re a forex trader with a $500 account. You decide to use a leverage of 100:1. You can now trade up to $50,000, even though your funds are much less. In this scenario, each dollar in your account effectively acts like $100 in the market. It’s like having a magnifying glass that makes your trading power a hundred times bigger than your real money.

Now, consider that the market moves in your favor and that your trade gains value. Even a slight percentage increase on the $50,000 position leads to a significant profit, much more than a $500 position would have earned. However, the risk is equally magnified. If the market moves against you, losses will also be amplified, and they can quickly exceed your original $500. This high-stakes situation highlights why leverage is powerful and risky in forex trading.

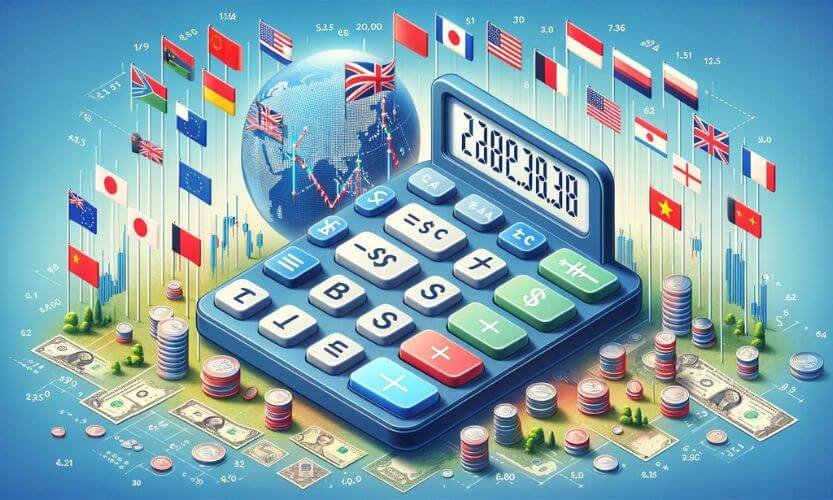

Leverage Calculation Formula Explained

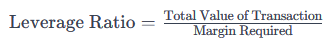

Divide your position’s total value by your account balance to determine leverage.

Say you have $1,000 and open a $50,000 position; your leverage is 50:1. Another way to calculate it is through margin, a required percentage of your position’s value in your account. The formula for this is 100 divided by the margin percentage. You can also utilize our automated margin calculator for free.

Example 1 for calculating leverage: First, look at the broker’s leverage ratio, like 1:50, 1:100, or 1:200. For instance, 1:100 means with $1 of your money, you can handle $100 worth of trading. To determine how much money you can manage with leverage, multiply your account balance by the leverage ratio. If your account has $1,000 and uses 1:100 leverage, you can handle $100,000 worth of trades.

This ratio also sets the margin requirement: the cash you need in your account to keep a position open. With 1:100 leverage, you need 1% of the total trade value as a margin. So, for a $100,000 position, you need $1,000 as margin. Remember, leverage can increase both profits and losses. If the market goes against you, you could lose a lot. Managing this risk is key in forex trading.

Example 2 for calculating leverage: Let’s say you start with $1,000 in your forex account. You choose to use 100:1 leverage, as offered by your broker. This means you can trade $100 for every $1 you own.

With this leverage, your $1,000 becomes a $100,000 trading position. It’s your $1,000, but it’s 100 times bigger because of the leverage.

Here’s the important part: If the currency’s value rises by 1%, your gains are on the $100,000. That’s a $1,000 profit, doubling what you started with. However, if the value drops by 1%, you lose $1,000. This clears out your account. That’s how leverage is risky. It can increase your earnings but also lead to significant losses.

Forex Leverage for Beginners: A Comprehensive Guide

Newcomers to forex trading who aim to gradually build up a passive income often have one common question: What leverage should I use?

The answer depends on several factors, including your balance, the securities you plan to trade, your broker, and your risk management and trading strategies.

Forex brokers often offer high leverage to traders who possess a small balance. They can’t trade with a small amount, like $10 or $100. The equity is just too low. Therefore, I don’t see any issues with picking a moderate leverage for your account. As long as traders stop loss in their orders and don’t risk more than 1% of their account in each trade, high leverage won’t cause issues, but it boosts your trading experience.

A leverage of 1:400 is neither too high nor too low, and with $500 in your balance, you can execute new orders and manage your trades smoothly.

While leverages are significantly high for major forex pairs such as EUR/USD, GBP/USD, and USD/JPY, the offered leverage is much less in other securities and CFD products. For example, the leverage for trading precious metals like gold and silver is usually half of forex. That means if your leverage is 1:1000 for trading the major currency pair, your leverage would be 1:500 on gold or less, depending on your broker’s leverage policy.

The table below shows the recommended leverage for trading forex with different balances.

Balance | Leverage |

0 - $1000 | 1:1000 |

$1,001 - $4,999 | 1:400 |

$5,000 - $9,999 | 1:1200 |

$10,000 and more | 1:100 |

Reducing leverage is because some securities or trading instruments don’t have enough liquidity. The daily trading volume for EURUSD is much greater than that of less traded currency pairs such as USDRAN (U.S. dollar or South African Rand). Therefore, popular securities have more leverage because there is more liquidity available.

The same sort of rules apply to cryptocurrencies. Even though cryptocurrency trading has been buzzing in the last few years, the market liquidity is not as significant as that of precious metals and currency pairs. Therefore, the leverage for trading cryptocurrencies is usually ten times less than that for forex. For example, if your leverage for trading GBPUSD is 1:1000, you can’t open a trade on Bitcoin with leverage greater than 1:10.

That said, you should read and study your broker’s website to understand what you are getting into.

The Pros and Cons of Using Leverage

Leverage’s main perk is trading big with less money, potentially boosting profits. Imagine using 1:100 leverage on a $100,000 position with $1,000; a 1% favorable market shift can double your investment. But a 1% shift against you can mean a 100% loss. If the market keeps moving against you, you might face a margin call, where the broker asks you to add funds or close positions.

What is the Best Leverage?

Choosing the best leverage for yourself is something personal and depends on several factors:

- Risk Tolerance: How much loss can you handle?

- Trading Approach: What are your trading frequency, position duration, and financial goals?

- Market Behavior: Consider the market’s volatility and liquidity.

- Broker’s Conditions: Look at the leverage limits and associated costs your broker sets.

Before you choose your leverage with your broker, think about these questions.

It’s essential to plan how you will trade carefully. If you trade often and quickly, making small profits, using higher leverage might benefit you. However, leverage isn’t as necessary if you’re a swing or day trader. Based on your account balance, you can manage your trades with lower leverage, like 1:200. Remember, swing and day traders sometimes hold their positions overnight. Therefore, you should also consider the swap charges your broker might apply.

Author’s tip: If you’re starting out, don’t like risks, trade infrequently, or work in unpredictable markets, go for less leverage. Those who are seasoned, okay with risks, trade often, or are in stable markets can go for more leverage.

However, remember that leverage isn’t a surefire way to succeed. While it helps achieve goals, it carries more risk (How Forex Hedge Can Mitigate Risk).

Be careful with leverage; never bet more than what you can handle losing.