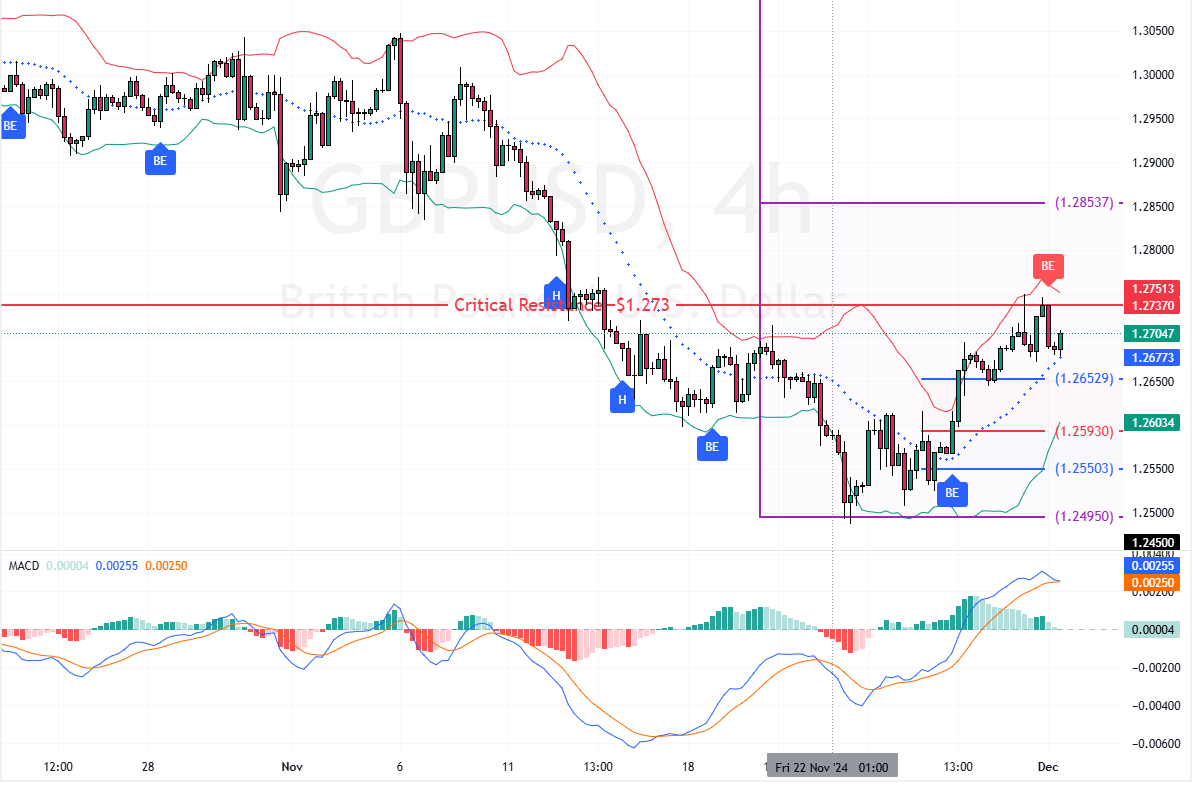

After the GBP/USD reached its lowest point six months earlier this month, the British pound struggled with the 1.273 critical resistance level.

However, investors remain cautious considering how Donald Trump could affect the economy. Trump has renewed his threats to increase tariffs, proposing a 10% hike on Chinese goods and a 25% increase on imports from Mexico and Canada.

Bank of England May Lower Rates After Poor Sales Data

In the United Kingdom, disappointing economic figures fuel expectations that the Bank of England might cut interest rates. Retail sales dropped by 0.7% in October, more than experts predicted.

Additionally, early indicators like the Purchasing Managers’ Index (PMI) fell short of forecasts, suggesting a slight slowdown in business activity for November.

UK Inflation Hits Six-Month High at 2.3%

On the other hand, UK inflation is on the rise. The annual inflation rate jumped to 2.3% in October—the highest in six months—from 1.7% in September.

This rate exceeds the Bank of England’s target and market expectations of 2.2%. Despite these mixed signals, most analysts believe the Bank of England will keep interest rates unchanged in December.