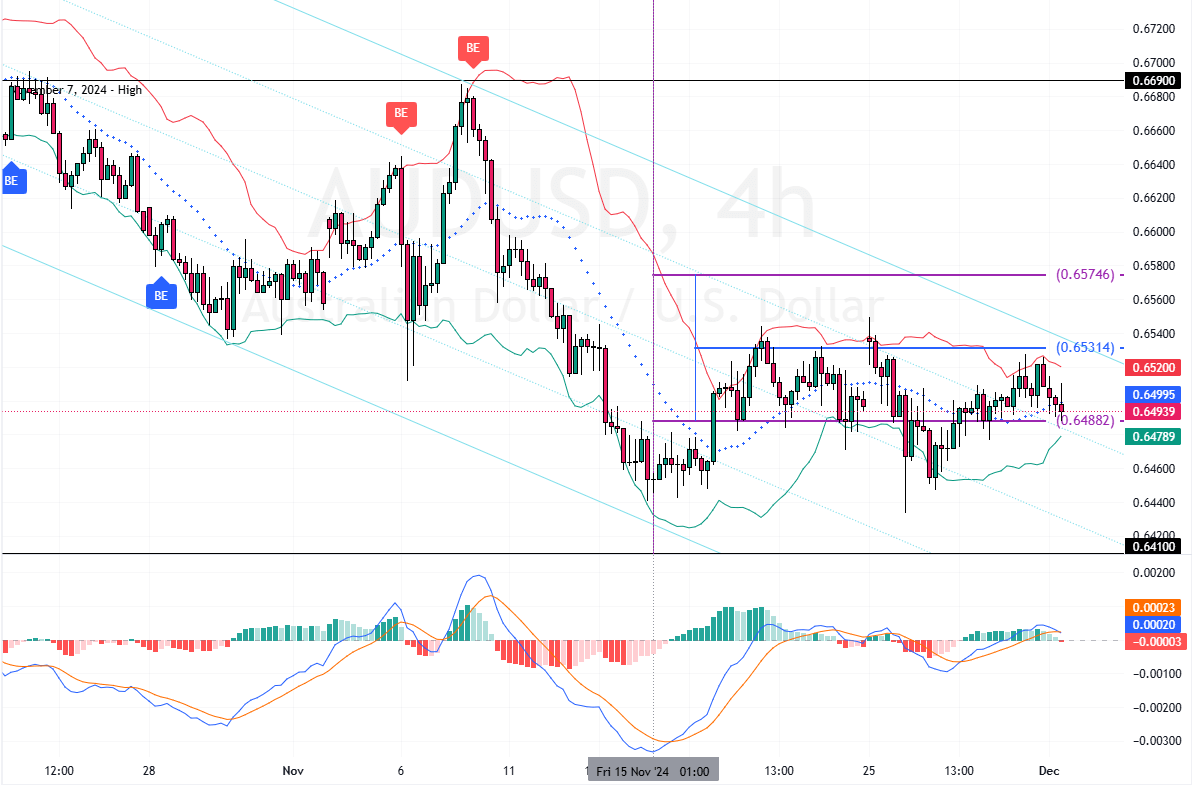

On Monday, the Australian dollar remained below the $0.65 resistance, which is also the upper line of the bearish flag.

The AUD/USD pair is currently wiping out gains from the previous three days. This decline happened because the dollar gained strength after U.S. President-elect Donald Trump warned BRICS nations with 100% tariffs if they attempted to create a new currency to replace the U.S. dollar.

Strong October Retail Growth Delays RBA Rate Cuts

In Australia, investors reacted to October’s retail sales data, which showed better-than-expected growth. This suggests that the Reserve Bank of Australia (RBA) is likely still some time away from making any interest rate cuts.

RBA Governor Rules Out Interest Rate Cuts Soon

Last week, RBA Governor Michele Bullock stated that core inflation remains “too high” to consider lowering interest rates soon. She emphasized that the bank would keep policies tight until there was more confidence that inflation would slow down.

Bullock also noted that more progress is needed before prices return to the RBA’s target levels.