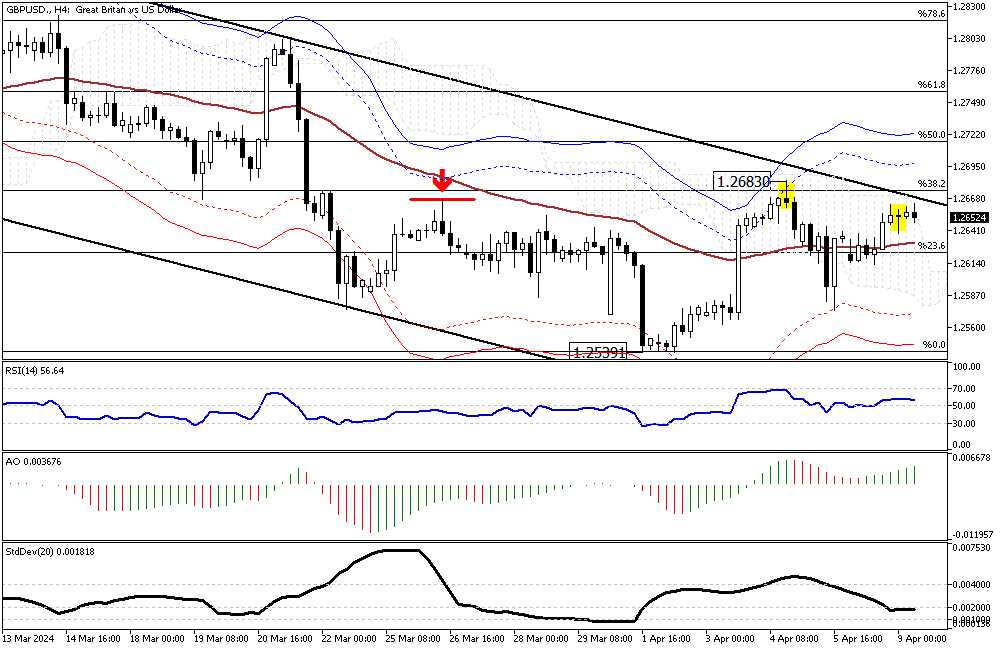

FxNews – Pound sterling trades at about 1.2653 against the U.S. dollar as of writing. That price is slightly below the 38.2% Fibonacci resistance and the upper band of the bearish flag, as depicted in the GBPUSD 4-hour chart below.

GBPUSD Technical Analysis

As for technical indicators, they are bullish, with the RSI indicator hovering above 50, and the awesome oscillator bars are green and above the signal level. However, the Standard deviation value is low at 0.0018, meaning the market has no trend or volatility. Therefore, there is a possibility for the trend to reverse from 1.265 or break out the %38.2 Fibonacci level.

From a technical standpoint, the primary trend is bearish, but for the downtrend to continue, the price of the GBPUSD should close below EMA 50 or the 23.6% Fibonacci support, which is the 1.2623 mark.

Conversely, if the price breaks the channel, the rise that began at 1.2539 will extend further and aim for the %50 Fibonacci resistance, the 1.276 mark.

UK Retail Sales Surge in March 2024

Reuters – In March 2024, retail sales in the UK saw a significant boost, recording a 3.2% increase from the previous year, marking the highest growth since August last year. This surge was mainly fueled by the anticipation of Easter, which increased food purchases for the holiday weekend.

March sales growth was a notable improvement over February’s figures, which showed a modest 1% increase and surpassed expectations of a 1.8% rise. Analysts believe that the decreased cost of living helped the increase in spending.

Helen Dickinson, the BRC’s chief executive, mentioned that after a challenging start to the year, there’s optimism that warmer weather will boost shopper confidence. She emphasized the importance of a robust retail sector for investment in towns and cities and the need for the future government to acknowledge this by reconsidering the high costs retailers face.