Our Gold market analysis discusses last month’s unexpected rise in US Non-farm Payrolls (NFP). The data, which surpassed expectations, showed a significant increase of 336,000 in September, notably higher than the predicted 170,000 and even exceeding the revised figure of 227,000 from the previous month.

Interestingly, the nation’s unemployment rate exceeded projections, reaching 3.8%. This unexpected rise in payrolls and unemployment rates has stirred discussions among economists and market watchers. Responding to this news, our gold analysis observes a rebound in gold prices from a 7-month low. This underlines the sensitivity of gold prices to economic indicators and underscores its role as a safe-haven asset.

- Next read: EUR/USD Market Analysis and Inflation Data

SEC Lawsuit Against Elon Musk

Reuters—In other news, the Securities and Exchange Commission (SEC) filed a lawsuit against Elon Musk on Friday. The lawsuit pertains to Musk’s recent acquisition of Twitter. Reports suggest that the SEC alleges Musk failed to provide testimony during its investigation into his takeover of Twitter.

The court filing stated, “The SEC staff is continuing its fact-finding investigation and, to date, has not concluded that any individual or entity has violated the federal securities laws.” However, it was also added that “Musk’s ongoing refusal was hindering and delaying” the investigation.

In response to these allegations, Musk’s lawyer stated, “The SEC has already taken Mr. Musk’s testimony multiple times in this misguided investigation – enough is enough.” This statement indicates a growing tension between Musk and the SEC.

Gold Market Analysis – Payrolls Effect Musks SEC Case

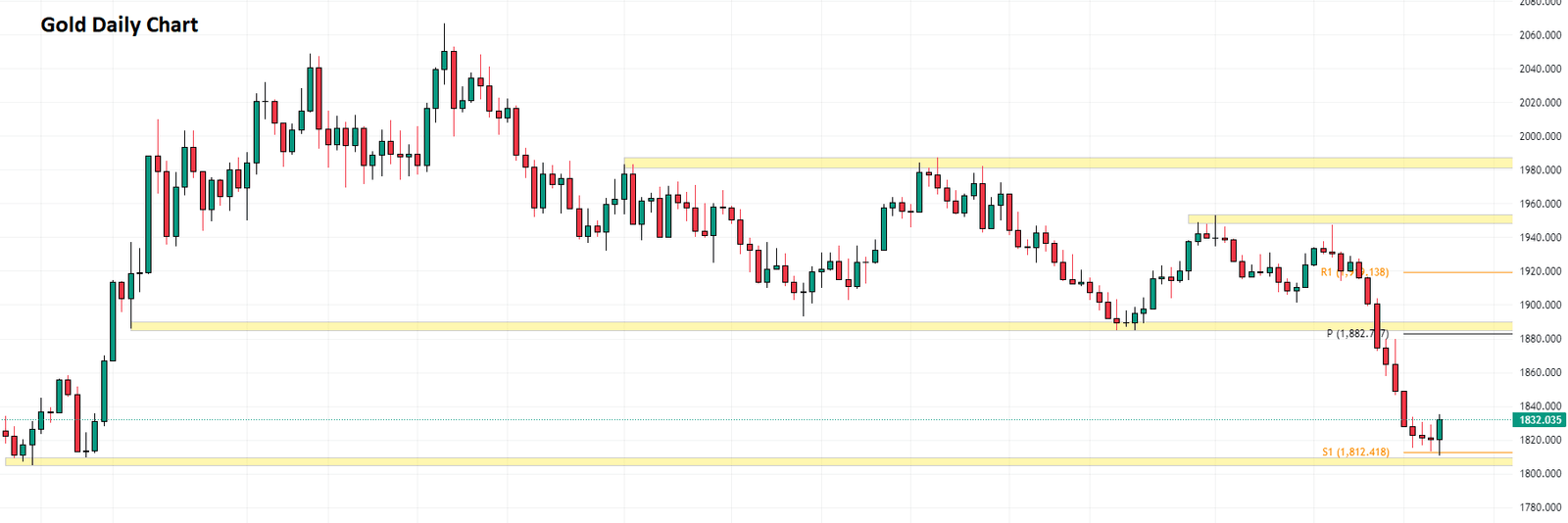

Our latest market analysis observed an anticipated rebound in gold prices from the $1,809 mark. This reaction was largely expected due to the oversold status of XAUUSD and the RSI indicator remaining below 30 since September 28th. If the bullish market can maintain the gold price above $1,804, our gold analysis suggests a potential rise in gold prices, possibly testing the broker resistance around $1,832.

However, suppose the bearish market gains momentum and pushes the gold price below the established support level. In that case, our gold market analysis indicates that we could witness a further decline in the value of this precious metal. This potential downturn is a critical aspect for investors and traders who are closely monitoring the gold market.

Staying updated with our comprehensive gold analysis for informed decision-making in this dynamic market is essential.