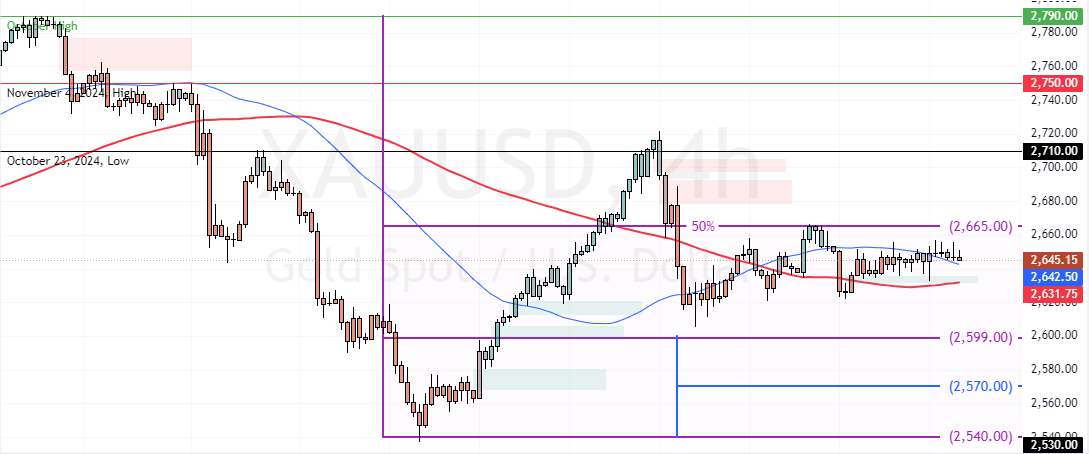

FxNews—Gold prices remained below the %50 Fibonacci resistance level at $2,665, staying within a narrow trading range as investors awaited signals from the Federal Reserve. With an important jobs report on the horizon, markets are closely watching for clues about future monetary policy shifts.

- Gold trades sideways below $2,655.

- Investors anticipate the Federal Reserve’s next move.

- Upcoming jobs report adds to market uncertainty.

Federal Reserve Signals Caution

On Wednesday, Fed Chair Jerome Powell indicated that officials plan to proceed carefully as they continue to lower interest rates, emphasizing the resilience of the U.S. economy.

However, recent data showed the services sector slowed more than expected in November. This slowdown has increased the chances of a 25 basis point rate cut in December, making this commodity more attractive by lowering the opportunity cost of holding non-interest-bearing assets.

- Good read: NATGAS Prices Hit $2.8 Low on Milder Weather

Global Uncertainties Boost Gold’s Safe-Haven Appeal

Ongoing global uncertainties strengthen gold’s status as a safe-haven asset. Political turmoil in South Korea and France, the conflict between Russia and Ukraine, and potential tensions between Israel and Lebanon if the truce with Hezbollah collapses are all contributing factors.

These issues drive investors toward gold as a secure investment option.