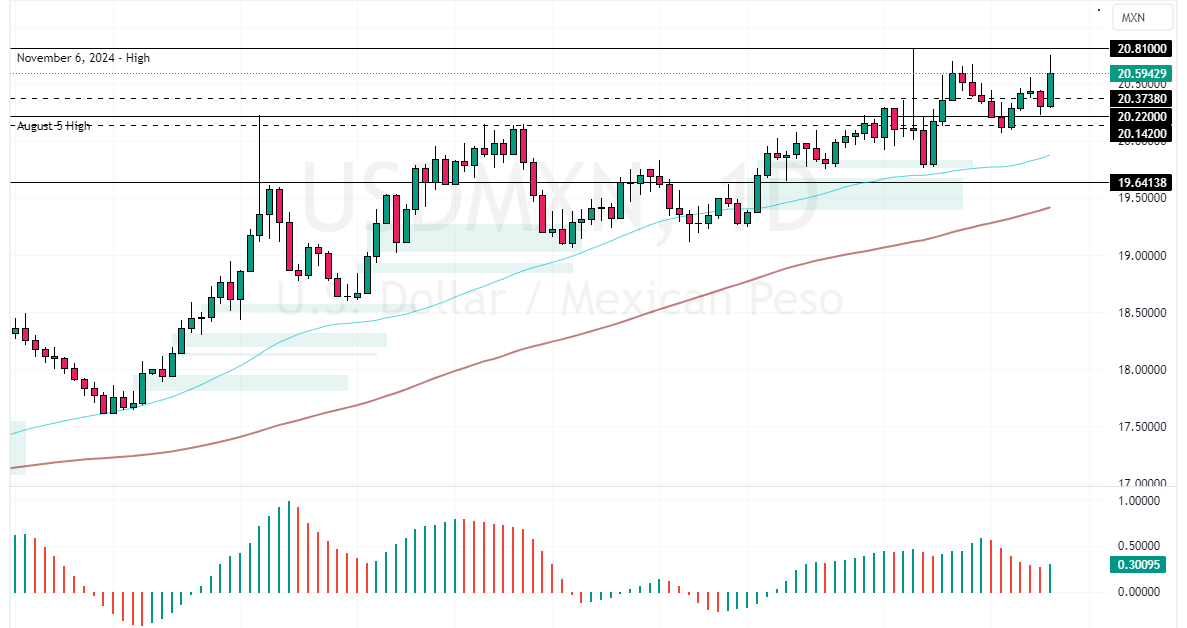

The Mexican peso is approaching a low not seen since July 2022, hitting nearly 20.6 against the US dollar. This drop coincides with mixed signals from economic reports and the rising strength of the US dollar.

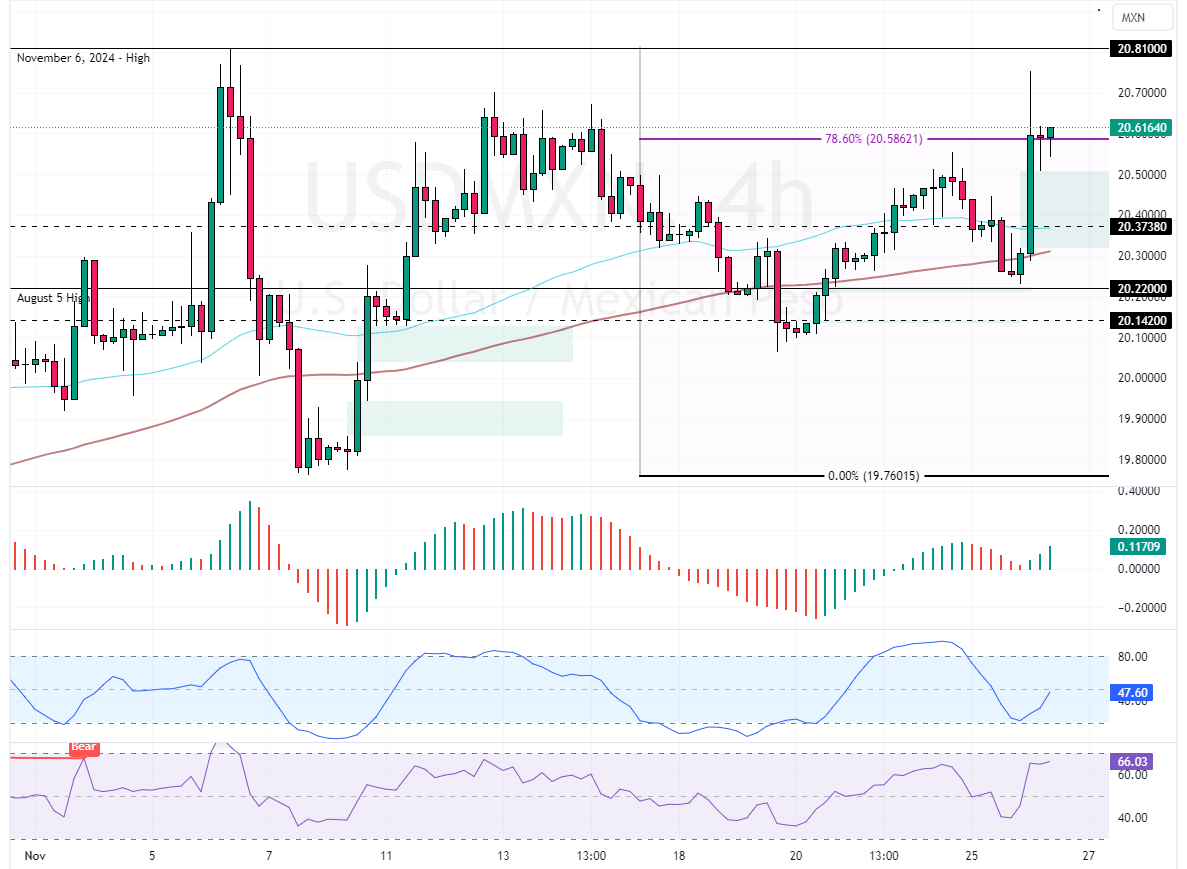

As of this writing, the USD/MXN trades at approximately 20.6, testing the 78.6% Fibonacci as resistance.

Mexico’s Economy Sees Fastest Growth Since 2022

In the third quarter of 2024, Mexico’s economy expanded by 1.1%, marking its quickest growth since early 2022 and surpassing initial estimates of 1% and expectations of 0.8%.

Meanwhile, Mexico reported a decrease in annual inflation to 4.56% by mid-November, the lowest in eight months. This was down from 4.69% the previous month and under the anticipated rate.

Peso Struggles Despite Mexico’s Growing Economy

Although Mexico’s robust economic growth suggests a slight decrease in interest rates might be possible, the peso remains under pressure due to the US dollar’s climb. This increase in the dollar is fueled by a strong job market in the US, steady policies anticipated from the Federal Reserve, and predictions about inflationary measures from President-elect Trump.

The appointments of trade hawk Robert Lighthizer as US Trade Representative and Marco Rubio, known for his firm policies on Latin America, as potentially the next Secretary of State, also raise concerns that add to the peso’s challenges.

- Good reads: GBPUSD Downtrend May Resume from $1.226

USDMXN Forecast – Bullish Trends Prevail as 20.22 Holds

The USD/MXN immediate support is at 20.4, backed by the bullish fair value gap and the 61.8% Fibonacci level. As for the technical indicators, the prices are above the 50-period simple moving average, meaning the primary trend is bullish.

Furthermore, the Awesome Oscillator histogram is green, and the RSI 14 and Stochastic depict 66 and 48 in the description. This indicates that USD/MXN is not overbought, so the uptrend will likely resume.

Overall, the technical indicators suggest the primary trend is bullish and should resume.

- Also read: EURJPY Aims for 163.0 as Key Support Holds

The outlook for the USD/MXN remains bullish as long as prices are above the 20.37 mark. In this scenario, prices will likely target the November 6 high as resistance.

Please note that the bullish outlook should be invalidated if USD/MXN dips below 20.22. If this scenario unfolds, a new bearish wave could emerge, targeting the 20.0 mark.

- Support: 20.5 / 20.37 / 20.22

- Resistance: 20.81 / 21.0