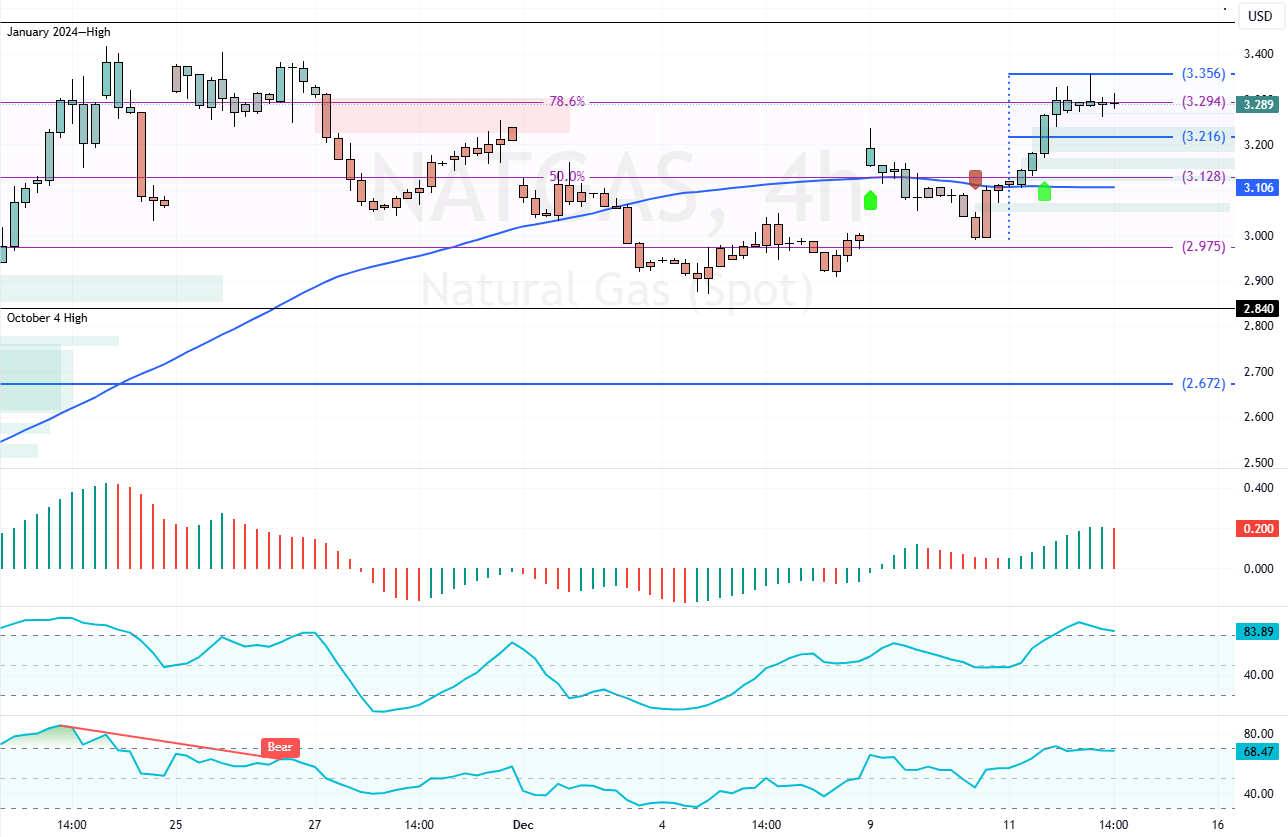

FxNews—The U.S. Natural Gas trades bullish above the %50.0 Fibonacci support level and the 75-period simple moving average. Interestingly, NATGAS formed a long upper shadow candlestick pattern in the 4-hour chart after the prices reached the 78.6% Fibonacci retracement level at $3.3.

As of this writing, the commodity tests the 78.6% Fibonacci level as resistance.

NATGAS Analysis – 12-December-2024

As for the technical indicators, the Stochastic and RSI 14 hint at an overbought market, recording 84 and 69 in the description, respectively. Additionally, the Awesome Oscillator recently turned red, meaning the bull market is weakening.

Overall, the technical indicators suggest that while the primary trend is bullish, prices could dip toward lower support levels.

NATGAS Tests Critical Resistance: Bears Target $3.21

The immediate support is at $3.21. From a technical standpoint, NATGAS could begin consolidating near the lower support levels if bears (sellers) push the prices below $3.21. In this scenario, the next bearish target could be $3.12, followed by $2.97.

The Bullish Scenario

Conversely, the immediate resistance is $3.35. If this level breaks, the uptrend will likely extend further. The next bullish target in this strategy could be the November high at $3.4.