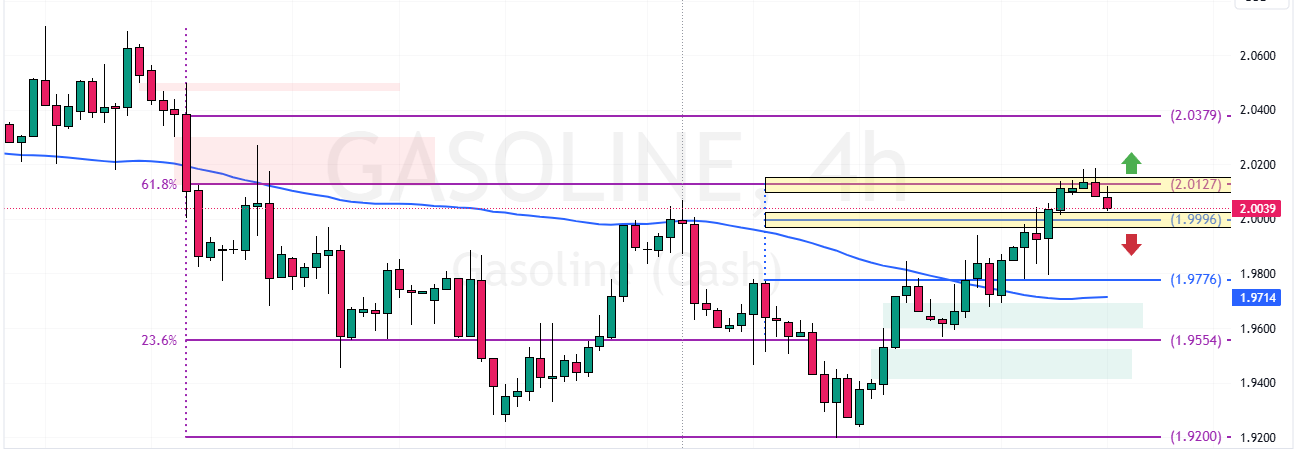

FxNews—Gasoline is bullish. However, a dip below $1.99 could trigger a bearish wave, targeting $1.977.

Conversely, a bullish break out from $2.012 could trigger the uptrend, targetting $2.03.

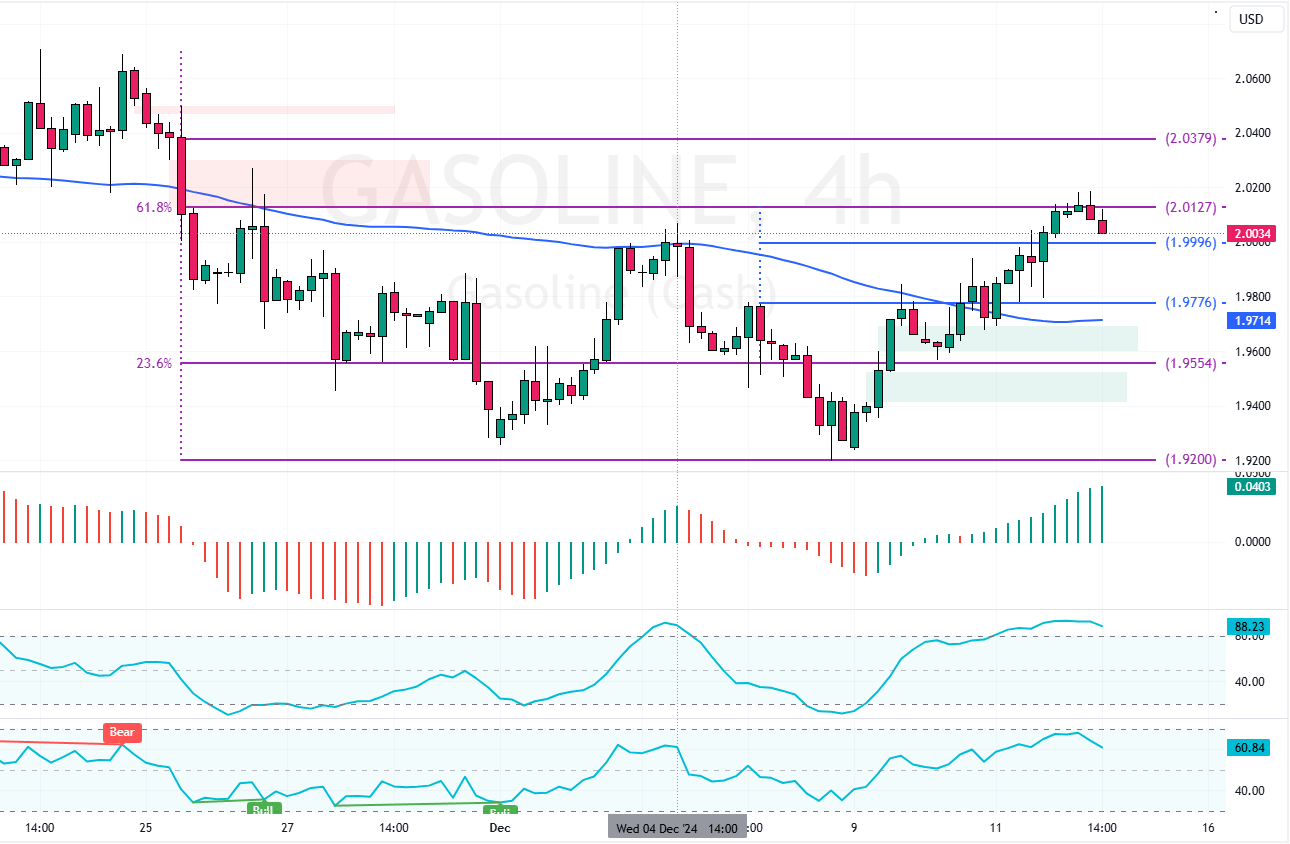

Gasoline Technical Analysis – 12-December-2024

Gasoline prices trade in an uptrend, above the 75-period simple moving average. However, the bull market eased after the prices hit the 61.8% Fibonacci resistance level at about $2.012. Consequently, Gasoline prices began to dip as expected due to the Stochastic hovering in the oversold territory, hinting at a saturated market from buyers.

As of this writing, Gasoline prices hover at approximately $2.003, while Stochastic records show 88, betting on a consolidation phase or trend reversal.

Gasoline Could Slide to $1.977 if Support Cracks

The immediate support is at $1.999. A new bearish wave could emerge if sellers push the prices below this support. In this scenario, Gasoline prices could dip toward the $1.977 support, backed by the 75-period simple moving average.

The Bullish Scenario

On the other hand, the immediate resistance rests at $2.012. The uptrend will likely extend if bulls (buyers) close and stabilize the prices above this level. The bullish strategy’s next target could be the 78.6% Fibonacci resistance area at $2.037.