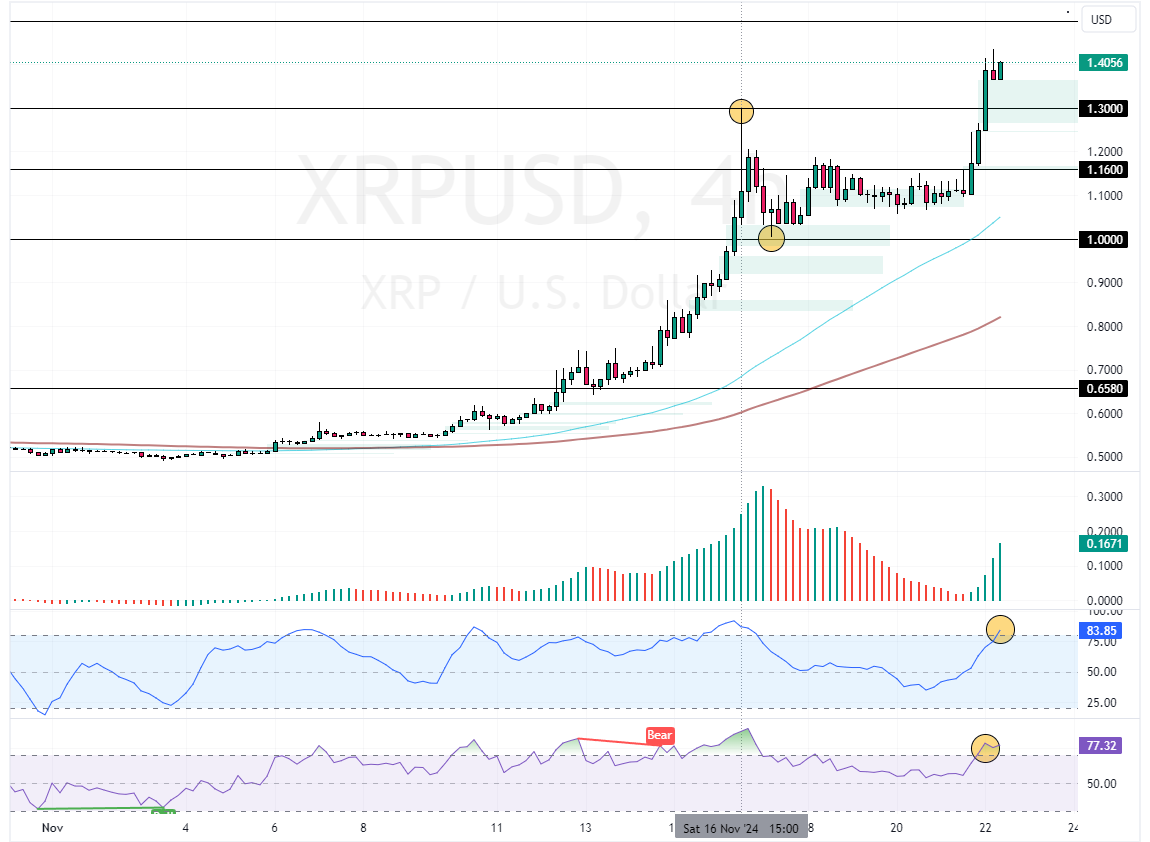

Ripple, known as XRP, resumed its bullish trajectory after the prices tested the $1.0 critical support level. Consequently, XRP prices surpassed the November 24 high of $1.3, forming a bullish fair value gap.

XRP/USD trades at approximately $1.39 as of this writing, paving roads to the $1.5 milestone.

RSI and Stochastic Show Overbought Market

As for the technical indicators, the RSI 14 and Stochastic Oscillator depict 76 and 83 in the description, respectively. These developments in the momentum indicators suggest the market is saturated with buyers.

Additionally, the 4-hour chart formed an inverted bearish candlestick pattern, hinting at a possible reversal.

Overall, the technical indicators suggest that while the primary trend is bullish, a consolidation phase could be on the horizon.

Ripple (XRP) Eyes $1.5 Despite Overbought Signals

From a technical perspective, Ripple (XRP) is overpriced in the short term. Therefore, waiting for the prices to consolidate near the immediate support of $1.3 is advisable. This supply zone offers a decent bid to join the bull market, aiming for $1.5, followed by $2.

Good read: Solana Tests All-Time Highs Amid Overbought Signals

Please note that the bullish outlook should be invalidated if the prices fall below $1.3. If this scenario unfolds, a new correction phase begins, which could result in the prices testing the 1.16 mark as support.