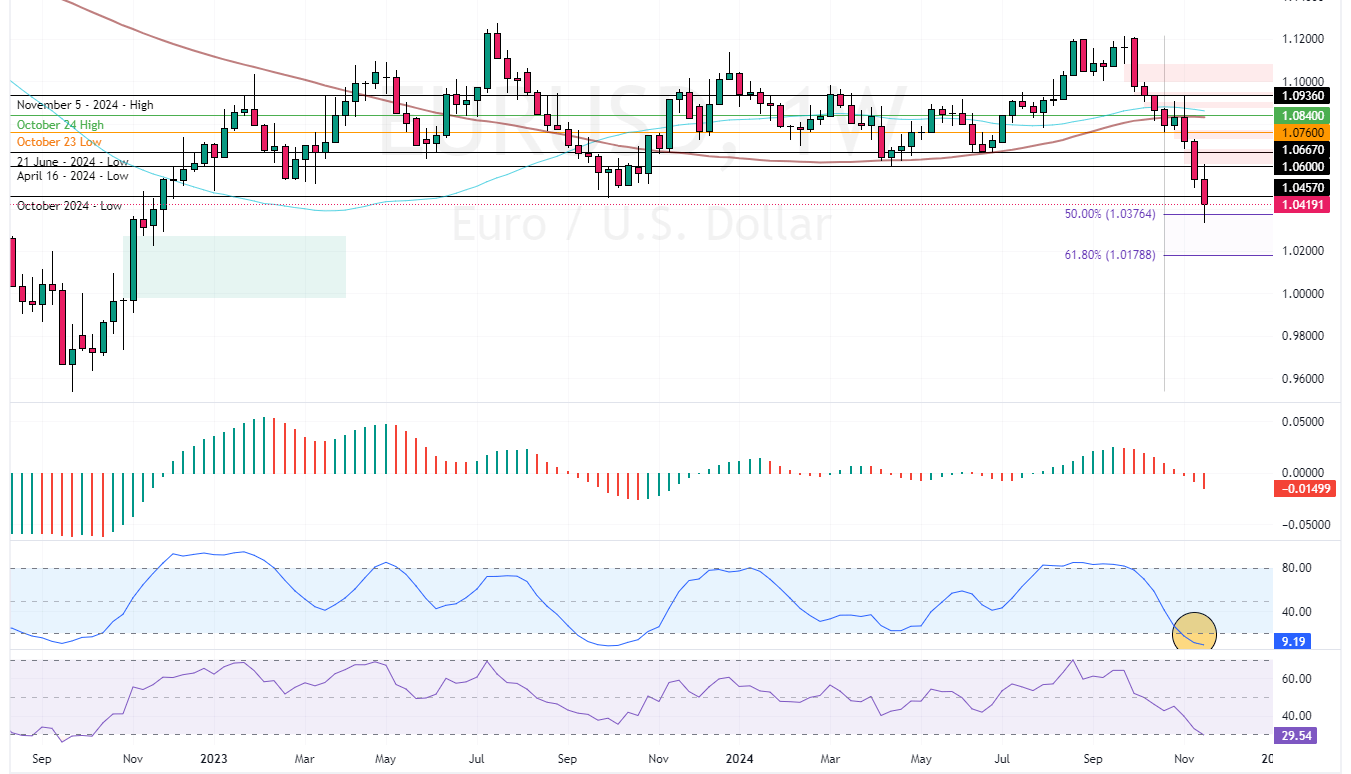

The European currency is in a robust bear market against the Greenback. In today’s trading session, it broke below $1.045, resuming its bearish trajectory. As of this writing, the EUR/USD pair trades at approximately $1.04, bouncing off the weekly %50 Fibonacci retracement level.

Key Indicators Show US Dollar Oversold Status

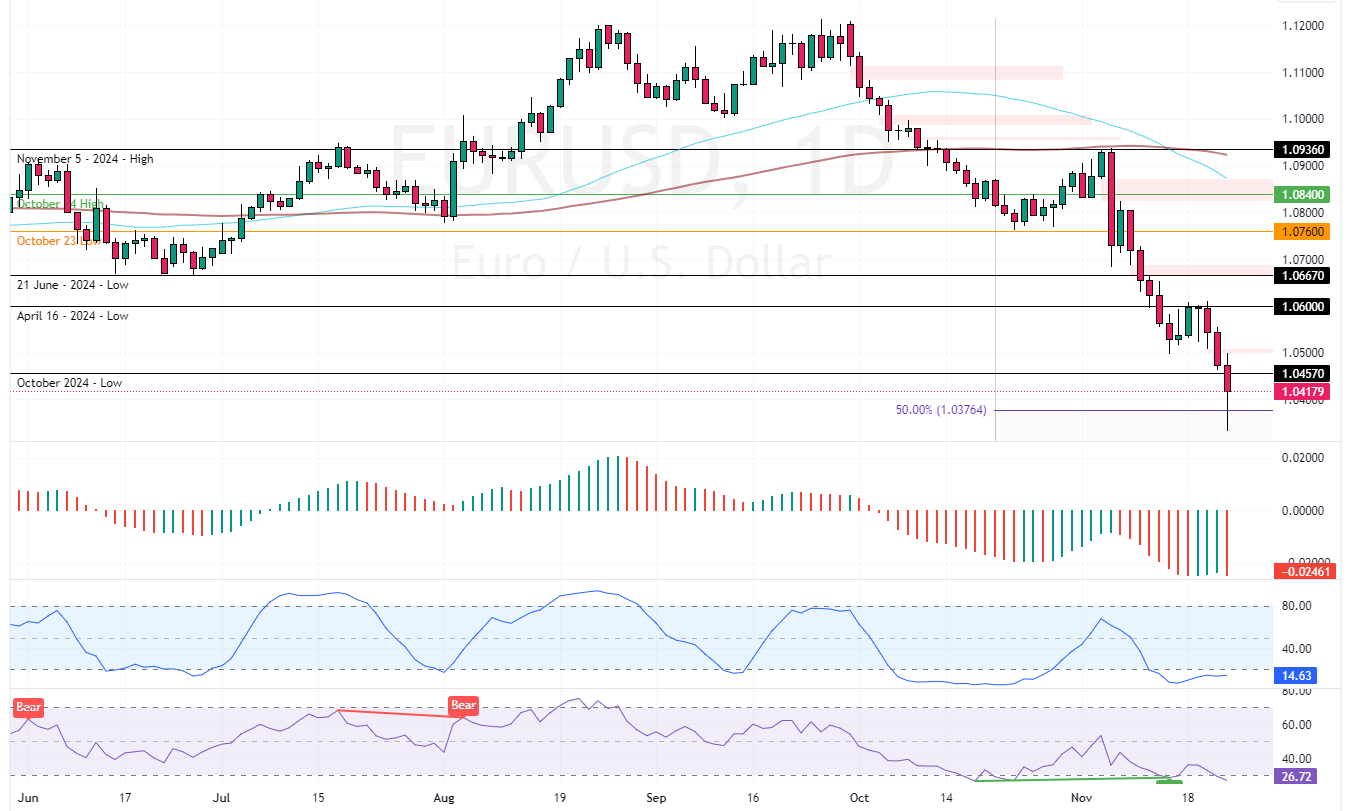

The first thing we notice when zooming into the daily chart is that the market is oversold. The Stochastic oscillator and RSI 14 hover below 20 and 30, respectively. This means the U.S. dollar is overpriced in the short term.

Therefore, waiting for the currency pair to stabilize near upper resistance levels such as $1.06 is advisable since it provides a decent and low-risk entry to join the bear market. Retail traders and investors should closely monitor the 1.06 demand area for bearish signals such as candlestick patterns.

Watch EURUSD for the Next Drop to $1.017

That said, the EUR/USD trend outlook remains bearish, with prices below $1.06. Furthermore, a new bearish wave could be generated if prices fall below $1.037 (the 50% Fibonacci level).

In this scenario, the next bearish target could be the 61.8% level at $1.017.