FxNews—Silver prices hovered around $33.5 per ounce on Thursday, maintaining their peak position in nearly 12 years. This surge reflects the growing demand for safe-haven assets amidst the uncertainties of the upcoming U.S. presidential election and the Federal Reserve’s policy decisions.

Markets on Edge as Election Day Approaches

With the election just around the corner on November 5, market participants brace for possible fluctuations due to heightened political uncertainties. Additionally, upcoming critical U.S. economic data could influence the Federal Reserve’s decisions on interest rate adjustments.

China’s Big Stimulus Could Boost Economy This November

Concurrently, global attention is focused on the National People’s Congress in China, which will take place from November 4 to 8. There is widespread anticipation that China might announce significant stimulus actions exceeding 10 trillion yuan to boost its economy.

This expectation has been further bolstered by China’s pledge to support the electric vehicle sector, including plans to expand the EV charging infrastructure, which has positively affected market sentiments.

Silver Technical Analysis – 31-October-2024

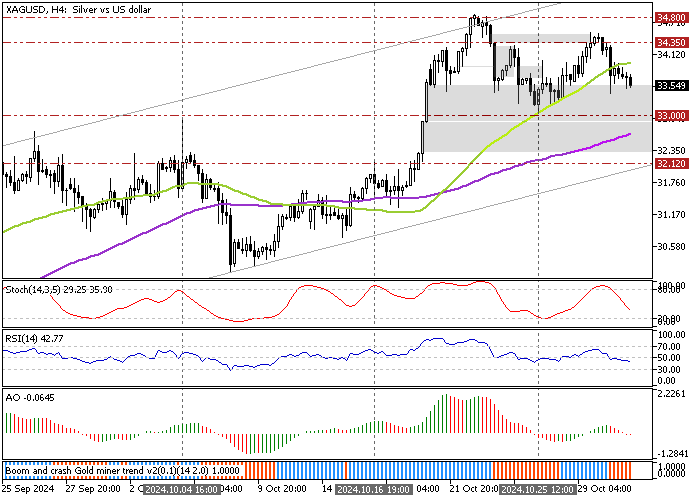

As of this writing, XAG/USD trades at approximately $33.53, stabilizing below the 50-period simple moving average. As the 4-hour price chart shows, Silver formed a higher low on October 30 at the $34.35 resistance, meaning the bull market weakened.

As for the technical indicators, the Awesome Oscillator flipped below the signal line with a red histogram, indicating that the bear market is gaining more momentum. The Relative Strength Index and Stochastic Oscillator are declining. Still, they are nowhere near the oversold territory, meaning the current bearish momentum in the Silver price has the potential to resume.

Overall, the technical indicators suggest that while the primary trend is bullish because Silver is above the 100-period simple moving average. It is likely that XAG/USD will consolidate near the lower support levels.

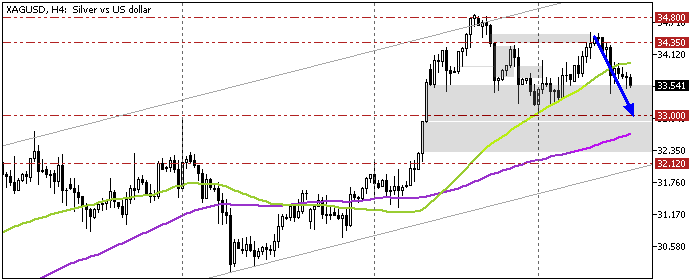

Silver to Test $33 if Bears Hold Below $34.35

The immediate resistance is at $34.35 (October 30 high). From a technical perspective, the current downtick momentum is likely to extend to the October 25 low at $33 if bears maintain the Silver price below that resistance.

Furthermore, if the selling pressure exceeds $33.0, the next support level will be the October 16 high at $32.1, backed by the ascending trendline.

The Bullish Scenario

If bulls pull XAG/USD above the immediate resistance at $34.35, the uptrend will likely resume. In this scenario, the next bullish target could be the October high at $34.8, followed by $37.

Silver Support and Resistance Levels – 31-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 33.0 / 32.12

- Resistance: 34.35 / 34.8 / 37.0