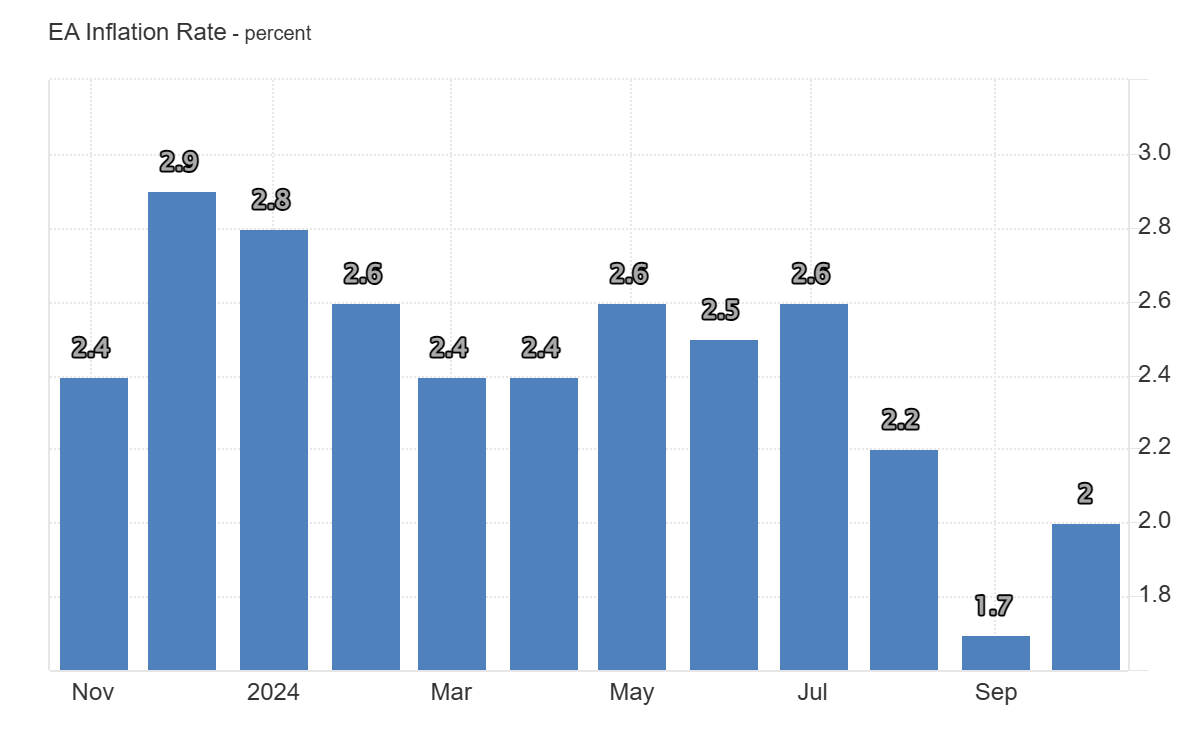

FxNews—In October 2024, inflation in the Euro Area increased to 2%, rising from 1.7% in September, the lowest rate since April 2021. This increase, slightly higher than the anticipated 1.9%, was expected due to previous sharp drops in energy prices no longer affecting the yearly calculations.

ECB Hits Inflation Target Despite Rising Costs

The inflation rate now meets the target set by the European Central Bank. Last month, energy prices decreased less sharply (-4.6% compared to -6.1%), while there were quicker rises in the costs of food, alcohol, and tobacco (2.9% versus 2.4%) and non-energy industrial goods (0.5% versus 0.4%).

Service prices, however, remained stable at a 3.9% increase. The annual core inflation rate, which does not include energy, food, alcohol, and tobacco prices, stayed steady at 2.7%. This is the lowest since February 2022 but still above the expected 2.6%. From the month before, the Consumer Price Index (CPI) increased by 0.3% after a decrease of 0.1% in September.

EURUSD Technical Analysis – 31-October-2024

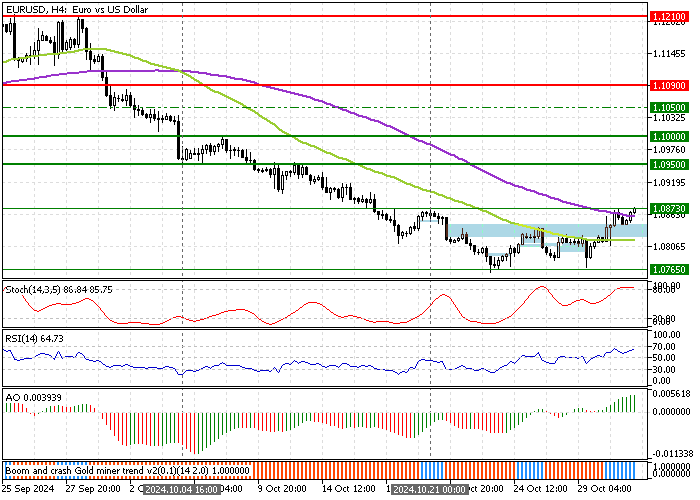

The EUR/USD price trades at approximately 1.087, testing the October high as resistance, backed by the 100-period simple moving average.

Concurrently, the Stochastic Oscillator is overpriced, indicating that the Euro is overpriced in the short term. That being said, the Awesome Oscillator recently turned red, suggesting that the bear market is gaining more momentum.

EUR/USD Poised to Hit October Low Again

From a technical perspective, the downtrend should resume if the immediate resistance at 1.087 holds. In this scenario, EUR/USD will likely revisit the October low at 1.076.

Bearish Scenario

Please note that the bearish outlook should be invalidated if EUR/USD exceeds the 100-period SMA at 1.087. If this scenario unfolds, the rise from 1.076 could extend to 1.095.

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.087 / 1.084 / 1.076

- Resistance: 1.087 / 1.095 / 1.10