FxNews—The Hang Seng Index fell by 321 points, dropping 1.6% to end at 20,381 this Wednesday. This decline marked the second consecutive day nearly all sectors saw a downturn. The upcoming US election and the Federal Reserve’s upcoming decision on interest rates added to market volatility.

China PMI Data Release Keeps Investors on Edge

Additionally, investors remained cautious because they were anticipating China’s October PMI data, which was set to be released the next day.

Despite these factors, a slight increase in US futures curbed further declines following Tuesday’s Nasdaq record-setting day. Next week, as senior legislative leaders meet, more details on China’s expected economic boosts may also be provided.

Beijing to Boost Economy with 10 Trillion Yuan Debt Plan

According to Reuters, Beijing could approve the issuance of more than 10 trillion yuan in new debt over the coming years to support economic growth.

On the downside, shares of electric vehicle manufacturers like NIO, Xpeng, and Geely Auto saw significant drops after the EU implemented new tariffs of up to 45.3% on Chinese-made electric vehicles starting today. Other companies that faced losses include Semiconductor Manufacturing, Meituan, and Tencent Holdings.

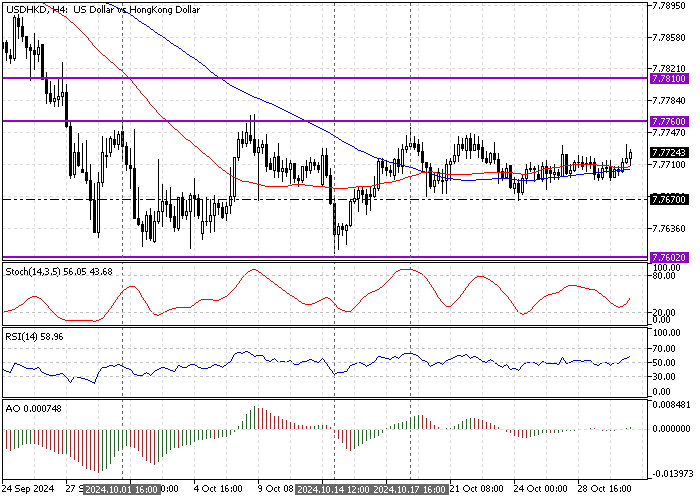

USDHKD Technical Analysis and Price Forecast

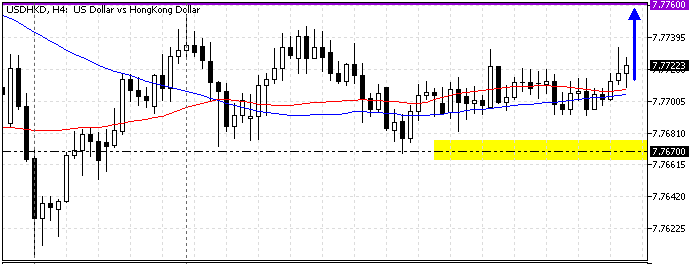

The currency pair has traded sideways since late September because the USD/HKD market lacks momentum and liquidity. As of this writing, the Greenback trades at approximately 7.772, slightly above the 100-period simple moving average, suggesting a mild bullish market.

USD/HKD Eyes Key 7.776 Resistance for Uptrend

The critical resistance level rests intact at 7.776, the October 1 high. From a technical perspective, the uptrend will likely resume if bulls close and stabilize the price above the 7.776 mark.

If this scenario unfolds, USD/HKD will step out of its sideways momentum, while the next bullish target could be the August 8 low at 7.781.

Bearish Scenario

On the flip side, a dip below the immediate support at 7.767 could trigger a new bearish wave that might lead to the USD/HKD price revisiting the October 14 low at 7.760.

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 7.767 / 7.760

- Resistance: 7.776 / 7.781