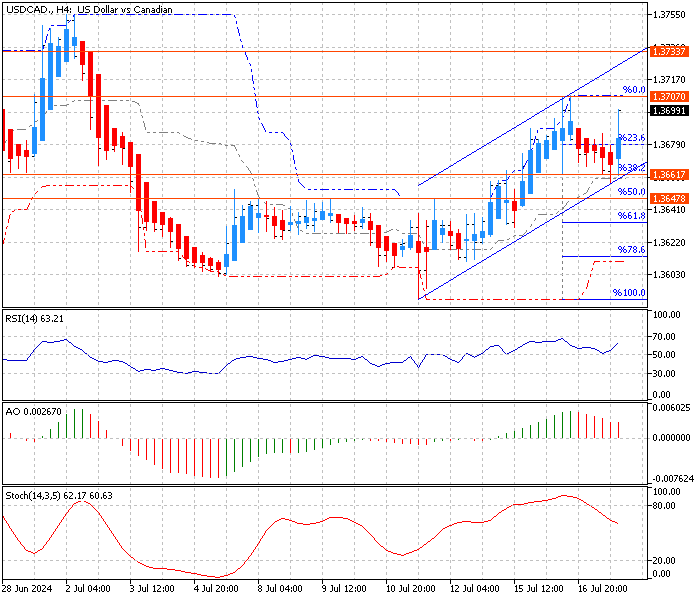

FxNews—The U.S. dollar bounced from the %38.2 Fibonacci at 1.366 against the Canadian currency, trading at approximately 1.369 in today’s trading session, and is rising. Interestingly, the USD/CAD pair trades above the median line of the Donchian channel and inside the bullish flag, indicating the primary trend is bullish.

The USD/CAD 4-hour chart below demonstrates the pair’s current price, the key support and resistance levels, and the technical indicators utilized in today’s analysis.

USDCAD Technical Analysis – 17-July-2024

Other technical indicators give mixed signals, suggesting uncertainty in the market.

- The awesome oscillator value is 0.002 and declines with red bars, but they are above the signal line, meaning the downtrend gains strength.

- The stochastic oscillator declines, meaning the bearish trend gains momentum.

- The RSI 14 is increasing, which signifies that the uptrend is gaining momentum.

Despite the mixed signals given by the momentum and oscillators in the USD/CAD 4-hour chart, the price is above the 50- and 100-period simple moving average, suggesting the primary trend is bullish and the currency pair’s price can rise to test the upper resistance levels.

USDCAD Price Forecast – 17-July-2024

From a technical standpoint, if the USD/CAD price remains above the key resistance level at 1.366, the bulls (buyers) will likely leap to test the July 16 high at 1.370. Furthermore, if the price exceeds 1.370, the next bullish target could be the May 28 high at 1.373.

USD/CAD Bearish Scenario

Conversely, if the bears (sellers) push the price below the 38.2% Fibonacci at 1.366, the bull market should be invalidated, and the subsequent supply level will be at the %50 Fibonacci at 1.364.

USDCAD Key Levels – 17-July-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 1.366 / 1.3647

- Resistance: 1.370 / 1.373