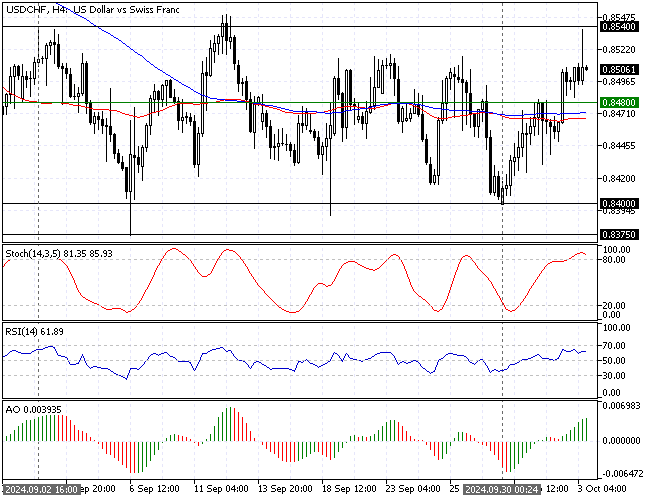

FxNews—The USD/CHF currency pair trades sideways between a wide range area, the 0.837 support, and the 0.854 resistance. The robust buying pressure that began at 0.840 (the September 30 Low) caused the Stochastic oscillator to signal an overbought by recording 87 in the description.

The 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

USDCHF Technical Analysis – Stuck in Sideways Trend

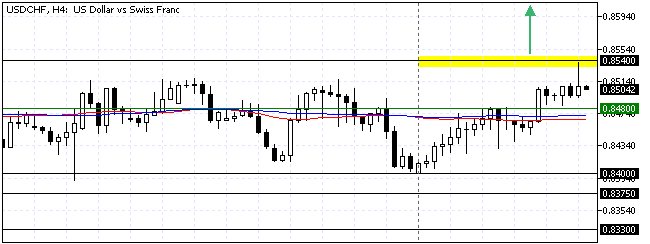

The immediate resistance is at 0.854, the September 2 high. From a technical perspective, if bulls (buyers) close and stabilize the USD/CHF price above 0.854, the uptick momentum from 0.840 can potentially aim for the August 14 low, the 0.862 mark.

Furthermore, if the buying pressure drives the USD/CHF price above 0.862, the next bullish target could be the August 15 high at 0.874. Please note that the bull market should be invalidated if USD/CHF dips below the 100-period simple moving average at 0.848.

- Also read: USD/JPY Technical Analysis – 3-October-2024

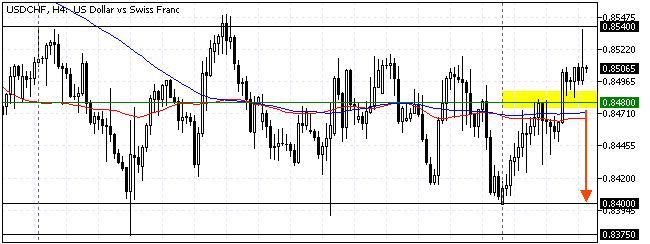

USDCHF Bearish Scenario – 3-October-2024

The immediate support is at 0.848, backed by 50- and 100-period simple moving averages. If USD/CHF falls below this support, the range market remains valid, and the decline will likely revisit the 0.84 support.

USD/CHF Support and Resistance Levels – 3-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.848 / 0.840

- Resistance: 0.854 / 0.862 / 0.874