FxNews—The USD/HKD downtrend eased when the price declined to the 2020 all-time low at 7.760. As of this writing, the U.S. dollar is experiencing a weak uptrend against the Hong Kong dollar, trading at about 7.766.

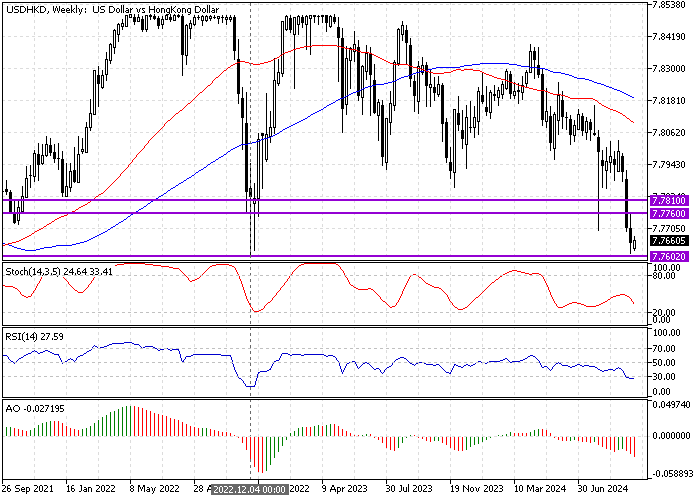

The weekly chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

USDHKD Technical Analysis – 7-October-2024

Zooming into the 4-hour chart, we notice the primary trend is bearish because the currency pair’s price is below the 50- and 100-period simple moving averages. However, the Awesome oscillator signals divergence in its histogram, meaning the USD/HKD price can potentially rise and test the 100-period SMA or upper resistance levels.

Overall, the technical indicators suggest the USD/HKD primary trend is bearish, but the price could increase.

USDHKD Forecast – 7-October-2024

The critical resistance level that kept the U.S. dollar from losing more ground against Hong Kong’s currency rests at 7.760. From a technical standpoint, the conversion rate can potentially experience a new bullish wave that could result in testing the 7.776 resistance (October 1 High).

Please note that the bullish scenario should be invalidated if the USD/HKD price falls below the critical resistance of 7.760. If this scenario unfolds, the downtrend will be triggered again, and the American currency will likely suffer further losses, with the next bearish target at 7.756.

- Also read: Oil Hit $76.5 Amid Middle East Tensions

USDHKD Support and Resistance – 7-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 7.766 / 7.756

- Resistance: 7.776 / 7.781