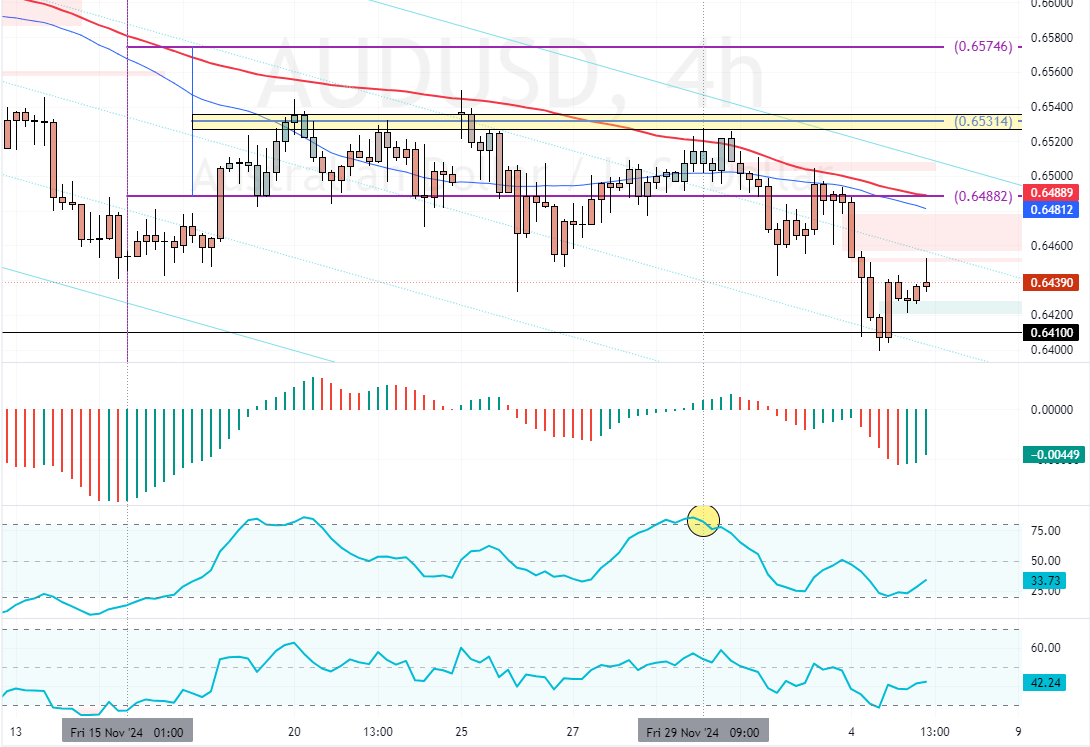

The Australian dollar steadied around $0.644 after Australia reported its largest trade surplus in eight months, driven by a rebound in exports. Despite this positive news, the AUD/USD currency pair remains near four-month lows due to weak GDP figures and global economic worries.

- Trade surplus hit an eight-month high.

- Export rebound supports the Australian dollar.

- AUD/USD is still near four-month lows.

Weak GDP Data Points to Possible Interest Rate Cuts

Australia’s recent GDP data showed quarterly growth of just 0.3% from July to September, missing market expectations of 0.4%. On an annual basis, the economy grew by 0.8%, below the forecasted 1.1%, a rate often associated with recessions.

This slow growth has increased expectations that the Reserve Bank of Australia might cut interest rates sooner than anticipated.

China’s Economic Issues and Tariff Threats Impact Aussie

Moreover, the Australian dollar is under pressure from concerns about China’s economic slowdown and tariff threats from US President-elect Donald Trump. As a liquid proxy for the Chinese yuan, the Aussie is sensitive to developments in China, Australia’s largest trading partner. These global factors continue to weigh on the currency.