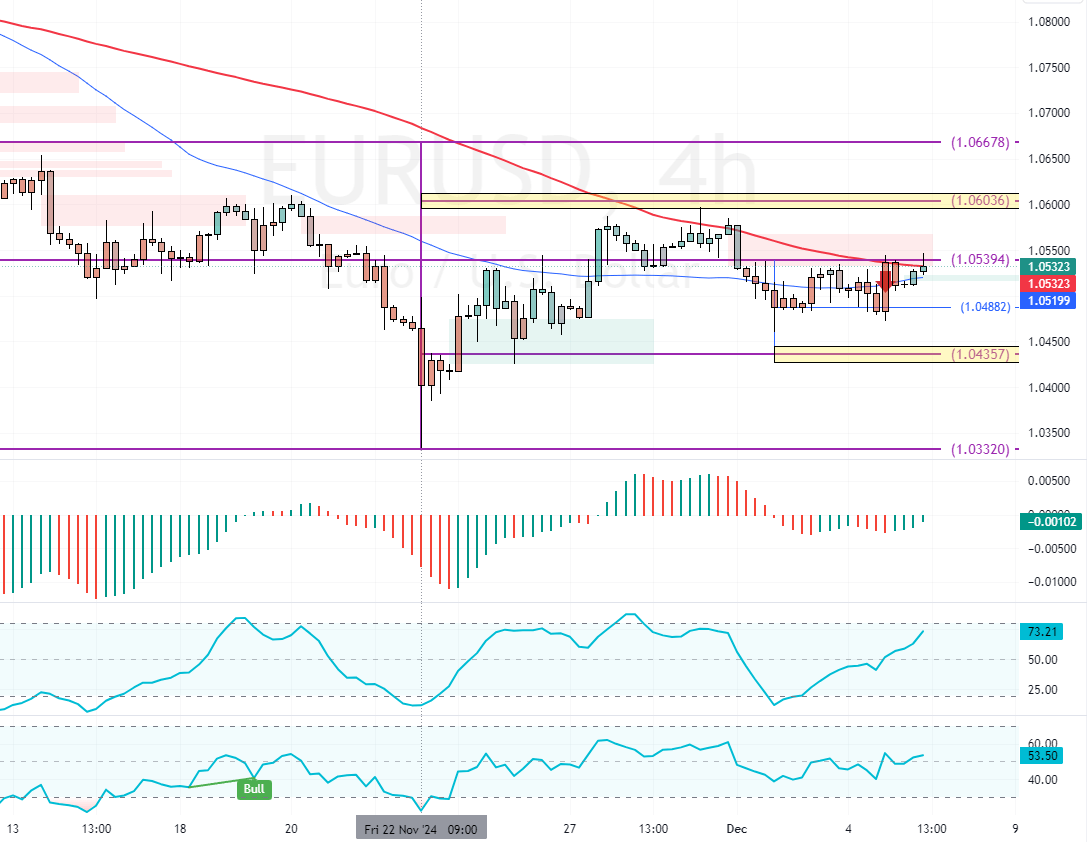

FxNews—The EUR/USD currency pair trades in a bear market, testing the 100-period simple moving average as resistance. As of this writing, the pair trades at approximately $1.052. Please note that the downtrend remains valid as long as the prices are below the $1.06 critical resistance.

From a fundamental perspective, the currency faces pressure due to escalating political instability within Europe and worries about the economic outlook. Many expect the European Central Bank (ECB) to continue easing its monetary policies.

- Euro trades near $1.052, close to two-year lows.

- Political instability in Europe affects currency value.

- ECB expected to maintain monetary easing policies.

Political Turmoil in France and Germany Pressures Currency

In France, the government collapsed after far-right and left-wing lawmakers united to pass a no-confidence motion. This unexpected political event has increased uncertainty in the Eurozone.

In Germany, early elections are scheduled for February, adding to the region’s political instability and impacting the euro’s strength.

- Next good read: AUDUSD Stabilizes at $0.643 After Trade Surplus Surge

ECB Rate Cuts Expected Amid Weakening Eurozone Economy

The Eurozone economy continues to struggle, with recent data showing that private sector activity is shrinking again. During a parliamentary hearing, ECB President Christine Lagarde warned that economic growth could weaken in the coming months, with risks leaning towards the downside.

The ECB is widely expected to lower its key deposit rate by another 25 basis points next week, but some speculate that a larger cut of 50 basis points could occur.