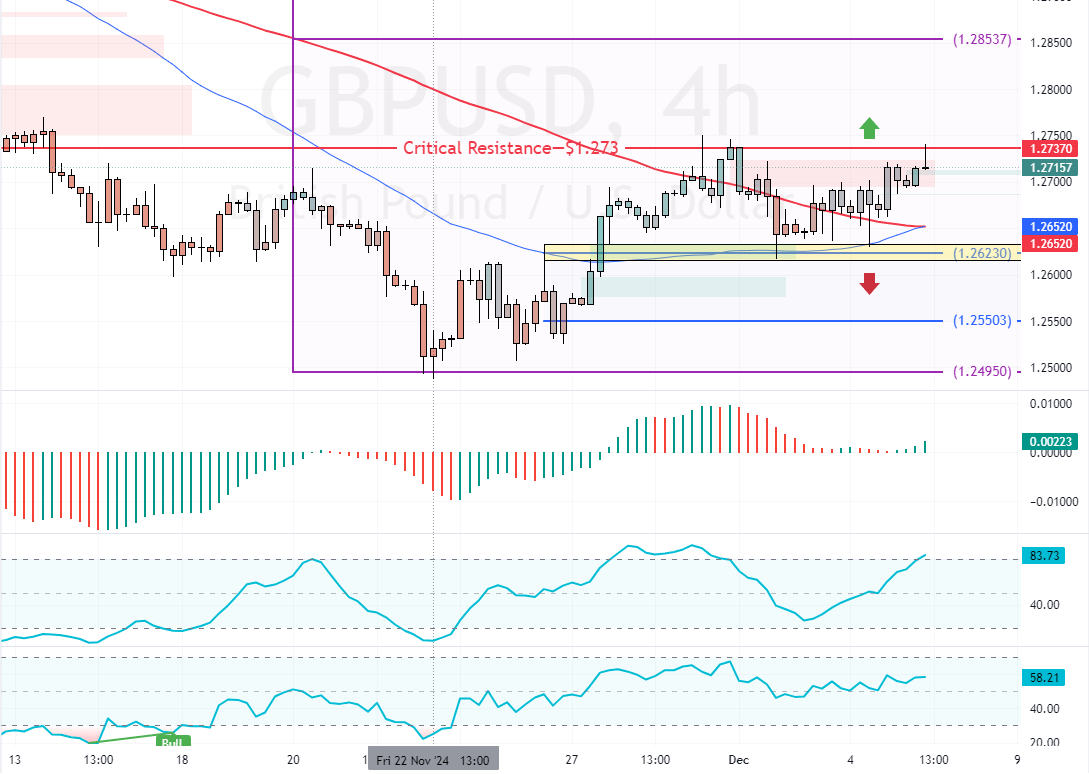

Following comments from Bank of England Governor Andrew Bailey, the GBP/USD currency pair remained stable at around $1.271, testing the critical resistance shown in the image below.

Bailey suggested that if inflation decreases, the central bank might implement four interest rate cuts next year, totaling a one-percentage-point reduction. This would lower the key interest rate to roughly 3.75%.

- Pound steady at $1.27 after Bailey’s interview

- Possible four rate cuts adding up to a 1% reduction

- The key rate could decrease to around 3.75%

- Rate cuts depend on ongoing inflation decline

Inflation Rates Present Mixed Signals

Bailey highlighted that inflation has dropped faster than expected, with current consumer prices nearly 1% lower than previous forecasts. However, recent statistics revealed that inflation increased to 2.3% in October from 1.7% in September.

These conflicting data points make future monetary policy decisions critical.

Weakening Services Sector Raises Economic Concerns

Meanwhile, the UK’s services sector is showing signs of weakness. Employment in this sector fell for the second consecutive month, though slower. This ongoing decline raises concerns about the overall health of the UK’s economy.